Examining the opposition case

Elections are not a time for considered economic analysis, but then few times are. Opponents of the free market are able to point out obvious flaws in recent economic trends, but are met with mere cheerleading by free-marketers. The appearance of an Obamaist policy document “Prosperity for All” written by Yale professor Jacob Hacker and Nathaniel Loewentheil is thus a useful opportunity to check out the opposition thinking, spot its flaws and ideological blind spots, but more important, determine where it indeed makes good points, and what the answer to them should be.

Perhaps the most powerful current argument against the relatively free market policies of 1980-2006 is that of recent U.S. trends in inequality. In economic principle, there should be no great preference for one income distribution over another, but in practice observation has found that both extremes are bad. Very flat distributions of income and wealth, especially if caused by government fiat, destroy wealth creation and suppress economic growth (and give too much power to government bureaucrats – more on that later.) Equally however very skewed distributions of income and wealth, if accompanied by democracy, produce economic stagnation at the bottom and therefore appallingly bad governments since the poor majority sees no way out of its impoverishment and votes for nut-job populists.

The main problem with the increase in inequality since 1973 (as it has not taken the U.S. particularly far out into the Latin American part of the curve) is the stagnation of income for the working class, in spite of 40 years of technological progress and productivity increase. In this diagnosis, “Prosperity for All” is correct; its explanation of why it happened and its suggested cures are however mostly misguided.

There are other areas of agreement. “Prosperity for All” decries the bad behavior on Wall Street and the “crony capitalism” of government handouts to favored industries. We can all agree on that, although when it comes to solutions the document proposes several that are equally crony capitalist. It proposes that Wall Street houses should be split between commercial banking and trading operations – again we can agree; it’s not a free-market solution, but with deposit insurance and an over-powerful Fed it may be the least bad second-best approach. It wants a Tobin tax on trading to reduce its profitability – again I agree, though I want a much smaller one that attacks primarily automated “fast trading” which essentially uses insider information on market activity.

“Prosperity for All” decries the lack of investment in infrastructure. Here I agree to an extent, but the problem is nothing to do with the free market; most infrastructure is provided by governments, which have incentives to build flashy new ziggurats like California’s high speed train and neglect maintenance. More seriously, infrastructure costs have been grotesquely inflated by union featherbedding, environmentalist nonsense and excessive regulation. The Holland Tunnel under the Hudson River, completed in 1927, cost $48 million, equivalent to $700 million today. New Jersey Governor Christie’s zapping last year of a duplicate tunnel, expected to cost $8.7 billion, indicates just how out of control infrastructure costs have become.

Finally, “Prosperity for All” decries the insecurity of the current economy, especially for those without great resources. Social security and Medicare programs are both endangered, and likely to cover fewer of the old-age costs of those now approaching retirement, especially with the rapid escalation in medical costs. The collapse in house prices has removed what many people saw as a net worth cushion that could be tapped in time of difficulty. College costs have soared, and the employability of college graduates has increasingly come into question. Here the effect of prolonged recession has merged with relentless cost escalation in education and medicine, the actuarial problem of baby boomer retirement and the effects of excessive leverage to produce a toxic increase in insecurity beyond that inevitable in a free economy.

Having given “Prosperity for All” credit for its successful diagnoses of many of our current ills, it is nevertheless impossible to be so complimentary about its proposed treatments. Its most egregious error is a refusal to accept that governments, unions and NGOs have incentives too, just like corporations. Consequently, however easy it may be for an optimal analyst in a comfortable armchair to propose government-directed solutions to economic problems, governments are no more likely to behave in a “socially optimal” way than are corporations.

This is the central fallacy of Keynesianism. Keynes himself was so convinced of the quality of his analysis that he negotiated an overvalued fixed exchange rate for post-war Britain that killed stone dead the surge of automobile exports planned by the brilliant William Morris, Lord Nuffield. Morris, who left school at 15 to work in a bicycle repair shop but was Britain’s most successful industrialist, was not someone Keynes was accustomed to consulting about the economy’s needs. The Keynesian Bureaucrat Fallacy, that bureaucrats of immense intelligence and complete incorruptibility can arrange the workings of the economy, is probably the most damaging economic belief of all time, even worse than Marxism.

Apart from its inability to invest efficiently, the most important failing of incentive-ridden government is in regulation. Agencies such as the Environmental Protection Agency and the Consumer Product Safety Commission exist simply to propagate and enforce regulations, and the more regulations they propagate and enforce, the more benefits in terms of remuneration, power and staff their senior officials obtain. Accordingly, we get nonsenses like the EPA regulation of carbon emissions, which may well shut down much of the U.S. power sector, thereby causing economic damage far beyond that sector.

Regulatory government is essentially irrational, and in practice pays little or no attention to the cost of the regulations it enforces – for example, a recent regulation banning “buckyball” products on the grounds children might swallow them, which bids fair to put a $50 million company out of business. As I have written previously in this column, it seems likely that the EPA’s advent was responsible for much of the decline in U.S. productivity growth after 1973, and that the current lethargy in the U.S. economy is at least partly due to the tsunami of new and expensive regulations under President Obama.

The cost of government favoritism is probably less than the cost of regulation, simply because the latter costs are so easy to hide. Nevertheless the entire clean energy program, based as it has been on science which increasingly looks chimerical, has been a bonanza of opportunity for the world’s least scrupulous businessmen. Not that “global warming” should be held entirely to blame; the corn-based ethanol boondoggle, pointless environmentally even if global warming were a problem, is a simple outgrowth of U.S. agriculture subsidies dating back to the 1930s. Needless to say, such programs almost never disappear, because the lobbies depending on them become so powerful; they only multiply.

A further fallacy perpetrated by “Prosperity for All” is the beneficial nature of unions and non-governmental organizations. Such entities, like governments, operate according to their own incentives dictating growth and the search for power. The best conditions for skilled and unskilled workers exist and have always existed in the most prosperous and fastest growing industries. Henry Ford’s $5 day, for example, the greatest single leap forward in unskilled-worker welfare of the twentieth century, was instituted in his entirely non-unionized plant in 1914, after the incredible success of the Model T. Automobile unionization happened only twenty years later, during the Great Depression and in the long run resulted in the U.S. automobile industry becoming hopelessly vulnerable to foreign competition. As for NGOs, their goals are political and their proliferation is entirely the result of the indefensible tax benefits given the “charitable” organizations. Remove those benefits, and NGOs would mostly wither away, leaving national prosperity very much greater for their absence.

Finally, “Prosperity for All” demands immediate legalization of the 10-12 million undocumented immigrants in the United States. Far from improving living standards, this would produce a further flood of unskilled undocumented immigrants, as did the 1986 amnesty. The result would be profits for Big Agribusiness but further immiseration of the less skilled half of the U.S. population. An economically successful society needs to be governed by the rule of law, and to ensure that its less productive citizens are able to get adequately paying employment without being subjected to wage-destroying competition from a flood of outsiders.

Since the problems identified by “Prosperity for All” are mostly genuine, and the solutions mostly chimerical, it behooves us to propose solutions that might actually work. Far from chivvying the Fed to satisfy its “full employment” mandate under the 1978 Humphrey-Hawkins Act, we need to reduce its remit to the single mandate of preventing inflation, and pass further rules so that its operations become “Volckerized” ensuring that henceforth it keeps interest rates high. With high interest rates, capital formation will be encouraged, and the United States’ traditional capital advantage over emerging markets will thereby be rebuilt, allowing its living standards and employment to remain at a satisfactorily high level because of its high ratio of capital to labor.

Tax reform is another essential. The current loopholes for home mortgage interest, state and local taxes, healthcare premiums and above all charitable contributions need to be removed, and the system pushed as far as possible towards taxing consumption rather than production. That way, the U.S. economy’s excessive dependence on mindless consumer spending will be removed, and it will become a high capital formation powerhouse like Germany and the best economies of Asia.

Markets in education and medicine must be reformed, by removing government subsidies and excessive regulation. That will make the reform of Medicare and Social Security very much easier, so that a Paul Ryan-style plan of limited targeted subsidy to those in need can be implemented, while costs are brought back under actuarial control. In these areas, foreign examples such as those of Germany and Japan are extremely useful, showing that quality can be improved and costs reduced without condemning America’s less fortunate citizens to sickness or illiteracy.

Finally, a bonfire of regulations must accompany a massacre of corporate welfare schemes. By these means, the economy will become more efficient and government costs will be greatly reduced, enabling proper provision to be made for the unfortunate while taxes are kept moderate, economic growth rebounds and full employment is restored in a natural unforced manner.

Looking at the detailed plans of political opponents is highly beneficial. Their diagnosis of society’s ills is often correct, and even if their solutions are misguided, one can at least ensure that one’s own plans address the ills they have identified. Nobody ever learned much through dialogue only with the like-minded.

SOURCE

*****************************

Generation squeezed

After the destruction wreaked by Obama and the Democrats, America is undoubtedly in the grip of a Carter-esque "malaise". Reagan rescued America from Carter; Could Romney be a new Reagan? The instinct is to laugh out loud at the idea that a former governor of Massachusetts could be a new Reagan. But don't forget that Reagan was a former governor of California. So perhaps there is hope. Below is one expression of the malaise --JR

I worry about the future -- not mine but that of my three children, all in their 20s. It is an axiom of American folklore that every generation should live better than its predecessors. But this is not a constitutional right or even an entitlement, and I am skeptical that today's young will do so. Nor am I alone. A recent USA Today/Gallup poll finds that nearly 60 percent of Americans are also doubters. I meet many parents who fear the future that awaits their children.

The young (and I draw the line at 40 and under) face two threats to their living standards. The first is the adverse effect of the Great Recession on jobs and wages. Even if this fades with time, there's the second threat: the costs of an aging America. It's not just Social Security, Medicare and Medicaid -- huge transfers from the young to the old -- but also deferred maintenance on roads, bridges, water systems and power grids. Newsweek calls the young "generation screwed"; I prefer the milder "generation squeezed."

Already, batteries of indicators depict the Great Recession's damage. In a Pew survey last year, a quarter of 18-to-34-year-olds said they'd moved back with parents to save money. Getting a job has been time-consuming and often futile. In July, the unemployment rate among 18-to-29-year-olds was 12.7 percent. Counting people who dropped out of the labor market raises that to 16.7 percent, says Generation Opportunity, an advocacy group for the young. Among recent high-school graduates, unemployment rates are near half for African-Americans, a third for Hispanics and a quarter for whites, notes the Economic Policy Institute, a liberal think tank.

The weak labor market hurts even job holders. From 2007 to 2011, "real" (inflation-adjusted) wages fell nearly 5 percent for recent college graduates and 10 percent for recent high-school graduates, says EPI. Among college grads, only four in 10 said their jobs required a four-year degree, reports a survey by the John J. Heldrich Center at Rutgers University. If the economy doesn't fully recover, slack labor demand will continue to depress employment and wages for years.

Of course, generalizations can be overdone. Countless millions of young people are doing -- and will do -- fine. History can't be predicted. The mass retirement of baby-boom workers may create job scarcities and raise wages. Still, some setbacks will endure. Some skills that would have been learned on the job won't ever be. Life decisions are deferred. Among 18-to-29-year olds, the weak economy is causing 18 percent to postpone marriage and 23 percent to delay starting a family, reports a survey by Generation Opportunity.

And then there are the costs of aging. Gains in productivity -- from new technologies or better skills -- that would normally flow into paychecks will be siphoned off to pay for retiree benefits, underfunded state and local government pensions and infrastructure repair. Taxes will rise; if not, public services will fall. Or both. Population change can't be repealed. The ratio of workers to retirees, 5-to-1 in 1960 and 3-to-1 in 2010, is projected at nearly 2-to-1 by 2025.

It's often said that today's young will ultimately benefit from this lopsided tax-and-transfer system. Old themselves, they will be similarly subsidized by their young. Doubtful. Sooner or later, the system's oppressive costs will become so obvious that future benefits will be curbed. Chances are the young will still pay for today's elderly without themselves receiving comparable support.

As a parent, all this rattles me. We judge our success by how well our children do. We love them and want them to succeed, even if most of us recognize -- at some point -- that our ability to influence and protect them has expired. Peering into the unfathomable future, we don't like what we think we see. We're dispatching them into a less secure and less prosperous world. These parental anxieties, I think, are the presidential campaign's great, unacknowledged issue. Many voters will decide based on a calculus of which candidate would minimize the economic perils for their grown children.

But the calculus will be selective. To aid the young, we could tighten Social Security and Medicare, raising eligibility ages and reducing payouts for wealthier retirees. Unlikely. Younger voters seem clueless about advancing their economic interests. In 2008, 18-to-29-year-olds supported Barack Obama by 34 percentage points. They love his pseudo-youthfulness. Or his positions on other issues (immigration, gay rights) trump economics. As president, Obama has done nothing to improve generational fairness.

If the young won't help themselves, their parents and grandparents might. They might champion revising retirement programs. Dream on. Parents and grandparents may be worried about their offspring's prospects, but they're not so worried as to sacrifice their own. There are real conflicts between the young and old; so far, the young are losing.

SOURCE

***********************

ELSEWHERE

Obama gets something right: "President Obama echoed the sentiments of the essential founder of the American experiment in his response to Sunday’s horrific killings at the Sikh Temple of Wisconsin. 'As we mourn this loss which took place at a house of worship,' said Obama, as the nation learned of a shooting spree by an alleged white supremacist at a place of worship in suburban Milwaukee, 'we are reminded how much our country has been enriched by Sikhs, who are a part of our broader American family.' That notion of the Sikh community as 'part of our broad American family' is not a new one. Sikhs have been a part of the American religious fabric for the better part of two centuries."

Gibson Guitar hit with grossly excessive penalties over “illegal” wood: "Nashville-based Gibson Guitar Corp. will pay a $300,000 fine and make a $50,000 community-service payment for conservation in response to federal allegations that the company used illegally obtained ebony wood in the manufacture of its products. The U.S. Justice Department issued the following news release about the settlement this morning: Gibson Guitar Corp. entered into a criminal enforcement agreement with the United States today resolving a criminal investigation into allegations that the company violated the Lacey Act by illegally purchasing and importing ebony wood from Madagascar and rosewood and ebony from India." [Obama's hatred of business on show]

*****************************

My Twitter.com identity: jonjayray. I have deleted my old Facebook page as I rarely accessed it. For more blog postings from me, see TONGUE-TIED, EDUCATION WATCH INTERNATIONAL, GREENIE WATCH, POLITICAL CORRECTNESS WATCH, GUN WATCH, FOOD & HEALTH SKEPTIC, AUSTRALIAN POLITICS, IMMIGRATION WATCH INTERNATIONAL, EYE ON BRITAIN and Paralipomena

List of backup or "mirror" sites here or here -- for readers in China or for everyone when blogspot is "down" or failing to update. Email me here (Hotmail address). My Home Pages are here (Academic) or here (Pictorial) or here (Personal)

****************************

The Big Lie of the late 20th century was that Nazism was Rightist. It was in fact typical of the Leftism of its day. It was only to the Right of Stalin's Communism. The very word "Nazi" is a German abbreviation for "National Socialist" (Nationalsozialist) and the full name of Hitler's political party (translated) was "The National Socialist German Workers' Party" (In German: Nationalsozialistische Deutsche Arbeiterpartei)

****************************

Wednesday, August 08, 2012

Tuesday, August 07, 2012

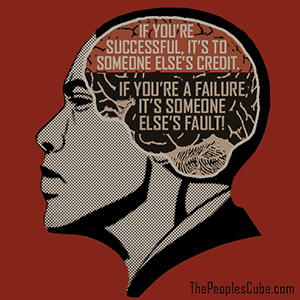

Built By Obama: What You See Is Not What You Get

The dark side of Obama's statement: collective achievement equals collective punishment

As Obama's "you didn't build that" quote is being probed and analyzed, I'd like to point out that the idea of redistributing other people's achievements is only a tip of an enormous ideological iceberg. Its invisible foundation sinks deep into the murky depths underneath the floating wreckage of American values.

Lest we take Obama's words out of context and are accused of "swift-quoting," let's review the full passage. Speaking at a campaign stop in Roanoke, Va., on July 13th, Barack Obama said:

"If you were successful, somebody along the line gave you some help. There was a great teacher somewhere in your life. Somebody helped to create this unbelievable American system that we have that allowed you to thrive. Somebody invested in roads and bridges. If you've got a business, you didn't build that. Somebody else made that happen. The Internet didn't get invented on its own. Government research created the Internet so that all the companies could make money off the Internet. The point is, when we succeed, we succeed because of our individual initiative, but also because we do things together."

A friend with a PhD in mathematics made this comment: "We scientists say that in order to make an apple pie from scratch, you must first build the universe - and that takes about four billion years. But that doesn't mean we can't build anything new from existing resources. So telling a businessman 'you didn't build that' is pure sophistry. Such phrases have always been a preamble to looting. Coming from the President, it's chilling."

Now let's put on our intellectual scuba gear to explore what lies beneath Obama's superficial altruistic bragging, which until now has served him as an unsinkable platform.

Apart from the simple untruth that "government created the Internet," Obama's words boil down to the old collectivist bromide that the individual is nothing without the society and the state. As one would expect, Obama didn't come up with it on his own. Standing on the shoulders of his collectivist predecessors, he ineptly restated Mussolini's motto: "All individuals or groups are relative, only to be conceived in their relation to the State." And Benito's fellow collectivist Adolf Hitler agrees: "Our nation can achieve permanent health only from within on the basis of the principle: The common interest before self-interest."

If the businessman "didn't build that," who did? Apparently, all of us did! And if the credit is equally shared, so must be the reward. Jackpot winners all! No more worries about paying the mortgage or filling the gas tank. This must be what thrilled Obama's voters during the 2008 election, as his speeches removed old moral barriers protecting other people's property and made it available to all, establishing a new morality of forced redistribution of wealth, previously known as looting.

But here's the catch: everything in this world has a price. If all of us can be credited for someone else's achievement, by the same logic, all of us can be punished for someone else's failure. Just as all individual credit goes to the society as a whole, so does all the blame. And if the entire group, class, nation, or race can gain moral authority because some of its members did something right, the same standard grants the moral authority to blame any other group, class, nation, or race because some of its members did something wrong. In the history of collectivism this concept translated into wars, slavery, pogroms, terrorism, ethnic cleansing, expropriation of wealth, deportation, internment, resettlement, and genocide.

It appears that the two notions, collective achievement and collective punishment, are as inseparable as two sides of the same coin.

But there's more: if nothing is to your credit, then nothing is your fault. What is the cost of that bargain? In a seemingly fair trade-off, we lose our right to individual achievements but gain the right to blame others for our failures. Collectivism provides us with a sufficiently analgesic illusion of fairness. If you turn out to be a loser, it's not because you are unqualified: on a whim, with objective standards removed, you can now self-righteously put the blame on those close to you, or on the unfair system, or even on the big wide (and deeply flawed) world.

Before you know it, your moral impulses are reduced to an immature tantrum of a toddler who breaks things and hits a babysitter; a teenager who curses at his family and blames the Universe for his pimples; a graduating student of Marxism at the Occupy Wall Street encampment who vandalizes private property and blames capitalism for not providing him with a high-income job; an aging member of the "drug revolution" who blames The Man and The System for his depression; or the President of the United States whoblames corporations and bank CEOs, modern technology and "messy democracy," Fox News and all other media, the Japanese tsunami and the Arab Spring, as well as Bush, Reagan, Congress, the GOP, and the entire city of Washington for his lack of achievement.

Coincidentally, such is also the moral foundation of collectivist societies, from Cargo Cult followers to the so-called People's Democracies. In the erstwhile USSR, the government redistributed not only the nation's dwindling wealth; it redistributed successes and failures. All achievements were credited to the Party and its leaders, as well as to a centrally appointed regiment of "Heroes of Socialist Labor," who conspicuously "sacrificed for the common good." The failures were blamed on foreign aggressors, Western imperialism, enemies of the people, kulaks, saboteurs, corrupt bureaucracy, irresponsible middle management, selfish greed, and lack of proletariat consciousness, as well as on natural disasters and bad weather. Sound familiar?

Find the guilty and the opportunistic politicians will come. The problem is, they come not to help you but to help themselves. The latest example is the current grievance-mongering U.S. government - a massive self-serving army of patented demagogues who have yet to improve one life or right a single wrong. In the final analysis, collectivism is a dead end. Releasing the floodgates of government corruption is only Act One in the drama of a declining nation.

Now that we have gotten to the bottom of it, let's review Obama's quote from this new perspective:

"If you have failed, somebody along the line ruined it for you. There was a lousy teacher somewhere in your life. Somebody helped to create this unfair American system that caused you to fail. Somebody benefitted from your demise. If you're a loser, it's not your fault. Somebody else made that happen. Titanic didn't sink on its own. Corporations and insurance companies made a lot of money off of it, so they must be complicit. The point is, when we fail, we fail not only because of our individual shortcomings, but also because others have teamed up behind your backs. Vote for me - I'll punish the guilty and give you what's rightfully yours."

It turns out that, after all, "someone else made that happen" is merely a flipside of "blame someone else." One can't exist without the other.

In contrast, the argument for individualism and competitive private enterprise cannot be "flipped" - not without distorting its nature and moral purpose. The statement, "It's my achievement and I have the right to what I earn," manifests only positive, objectively true human values.

Unlike its alternatives, capitalism doesn't grow out of a dark, indiscernible mass of moral entanglements. And unlike crony capitalism - a corrupt monster created by government intrusion into the economy - free market capitalism is transparent. Just like the greatest invention of our time, the personal computer (brought to us by free enterprise), capitalism has a user-friendly interface: WHAT YOU SEE IS WHAT YOU GET.

SOURCE

*******************************

Chik-fil-A-Quake: What the Media Didn't Say

If the media reports an earthquake was a breeze in the forest, did the earth still move? I’m not sure TownHall Finance is the natural venue for that question, but I’m also not sure why the Denver Post—my local paper—put a significant political and cultural event on page umpty-something, in the business section.

If you didn’t see it with your own eyes, you might have missed something big last week. Under fire by gay activists and their media amplifiers, Chick-fil-A CEO Dan Cathy unapologetically confirmed he supports the biblical definition of family as he understands it. This modern heresy quickly went viral. Reaction was harsh. Big city mayors and councilors channeled Al Capone with a badge: “Don’t file no stinking permit applications in our town, Chick-fil-A!” Pundits nodded righteously. But, what happened next didn’t follow the script.

Backlash welled up, not just from social conservatives, but fiscal conservatives and libertarians, outraged that politicians would trample the First Amendment, brandishing political litmus tests for the right to do business. Social media and web commentary buzzed with rebellion. A great day of fried chicken and Chick-fil-A appreciation was proposed.

Last Wednesday, I met friends in north suburban Denver at about 11 to beat the rush. Fail. The lot was packed, the drive-thru and building tightly coiled by a boa of cars, tail extending to the street. Inside was standing room only, with a switch-back line that triggered post-Disney traumatic stress. Yet, amid the din, cheer was high. The besieged staff moved helpfully and efficiently, and the line shuffled like a smooth deck of cards.

The friendly mob cycled through, holding steady in size the hour I was there. Judging scientifically by anecdotal Facebook posts, it stayed that way all day and evening, at every Chick-fil-A around Denver, throughout the state, and across the nation. The outpouring was unforeseen, the magnitude unimaginable. The chain’s coffers got a short- and probably long-term boost.

After 20 years around politics, I’ve seen how activists can generate pretty good ink just from a press release and 50 people on the Capitol steps in front of a borrowed guitar amplifier. I also know how hard groups sometimes have to hustle to assemble their 50. So I was eager to see what the media would make of this human tide.

Thursday’s Denver Post business page answered: “Coloradans voice their opinions on Chick-fil-A; Outlets flooded by supporters and opponents.” Not even close. Without space to fully deconstruct, I’ll acknowledge the article did say the crowds were large and the protesters few. But the headline and details caught maybe half the story and missed the essence. A few thoughts, on the event and the coverage:

Especially without any central organizer or major media promotion, the numbers were staggering, and broadly replicated across the country. If a protest warrants a story, this event deserves a Pulitzer-nominated multi-part investigative series.

It wasn’t a forum about the First Amendment, Cathy’s marriage views, or even political bullying. Whatever their motivation, the crowd arrived as a smiling, hungry lunch and dinner crew. It was a massive show of implicit support and protest, for reasons that deserve examination.

My table included a friend who supports civil unions, one for gay marriage, and one who thinks government should get out of the marriage business, letting people and churches make their own agreeable arrangements. We didn’t discuss the fourth person’s view, or anyone else’s that day, because lunch was don’t ask don’t tell.

It’s clear many diners intended to rebuke bullying politicians and the un-American idea that approved political views are required for permission to be in business. Does this resentment go further, and reflect anger at transgressed lines between private and public management, corporate and government bedfellows sharing money, policies, and favors? Is that resentment building toward a November eruptian?

Another strong positive is rejection of a vicious double standard: One side airs views through a respectful media, while others get vilified for different opinions. It’s breathtaking that liberals seek to redefine fundamental cultural concepts and muzzle the opposition; those who question or disagree should be attacked and cowed into silence, even while they speak for majority opinion. That happened with California’s ballot measure on marriage, as more than one financial supporter was hounded from high profile jobs. Wednesday was a salutary fist at that ugly trend.

Finally, what to make of the subdued coverage. Did our scribes not recognize an important cultural moment? Because it doesn’t interest them or flatter their vision? That’s the fish-don’t-know-they’re-wet view of media bias. Or, do they know full well and work carefully to contain the story? Of course, either way, the effect is the same.

SOURCE

*******************************

ELSEWHERE

Social Security not deal it once was for workers: "People retiring today are part of the first generation of workers who have paid more in Social Security taxes during their careers than they will receive in benefits after they retire. It's a historic shift that will only get worse for future retirees, according to an analysis by The Associated Press. Previous generations got a much better bargain, mainly because payroll taxes were very low when Social Security was enacted in the 1930s and remained so for decades."

Obama's fake birth certificate and other stories that don’t get covered: "Based in Washington, D.C., Diana West writes a weekly column nationally syndicated by the Universal Press Syndicate in Kansas City. It's a courageous column tackling topics seldom broached in the pages of many mainstream dailies. ... 'You're not being paranoid, it's absolutely true,' Ms. West replied. 'For a journalist, the comfort zone of discussable topics is definitely shrinking.'"

Why we shouldn’t tax companies: Because companies don’t pay taxes: "It's not unusual to hear the economically illiterate insisting that companies must pay more in taxes. This is illiterate because companies do not pay taxes. They cannot, for only people can bear the burden of a tax: someone's wallet has to get lighter and that wallet must belong to a person."

Counsel of despair?: "Over the years, I have heard many people say that the government’s adoption of a laissez-faire stance during a business recession or depression amounts to 'do-nothing government' -- the unstated assumption always being that it is better for the government to 'do something' than to do nothing. Recommending such a hands-off stance is often described as a 'counsel of despair.' Moreover, it is frequently added, in a democratic polity, the electorate will not tolerate such a policy. Implicit in such criticism is the assumption that the government knows how to improve the situation and has an incentive to do so."

Government Motors goes subprime: "President Obama continues pointing to his crony bankruptcy bailout of GM as a success. ... Now it turns out that much of the recent sales growth GM has bragged about is due to GM jacking up its sales with subprime loans."

Parenting bill could split baby many ways: "State Sen. Mark Leno wants California to recognize that a child can have 'more than two legal parents.' So he wrote a bill, SB1476, which, he argues, doesn't change the definition of a parent (for example, live-in lovers would not qualify) but allows family court to recognize more than two parents only 'when it is required to be in the best interest of the child.' He stresses that if the bill becomes law, 'None of our sponsors or supporters believe that this authority will be used very often.' SB1476 is for rare cases, Leno argues, like baby M.C., as she is known in court documents."

Obama shows what he thinks of the military: "In a move that puts new meaning to the term battleground, President Obama's re-election campaign and members of some military groups are on a collision course over voting rights in the critical state of Ohio. The Obama campaign and the Democratic National Committee have filed a lawsuit to block a new state law allowing men and women in uniform to vote up until the Monday right before an election, while the cutoff on early voting for the rest of the public is three days earlier. Men and women in uniform typically get more time than other voters to send in absentee ballots since they may be serving in an overseas or domestic location that is not close to their home polling station."

*****************************

My Twitter.com identity: jonjayray. I have deleted my old Facebook page as I rarely accessed it. For more blog postings from me, see TONGUE-TIED, EDUCATION WATCH INTERNATIONAL, GREENIE WATCH, POLITICAL CORRECTNESS WATCH, GUN WATCH, FOOD & HEALTH SKEPTIC, AUSTRALIAN POLITICS, IMMIGRATION WATCH INTERNATIONAL, EYE ON BRITAIN and Paralipomena

List of backup or "mirror" sites here or here -- for readers in China or for everyone when blogspot is "down" or failing to update. Email me here (Hotmail address). My Home Pages are here (Academic) or here (Pictorial) or here (Personal)

****************************

The Big Lie of the late 20th century was that Nazism was Rightist. It was in fact typical of the Leftism of its day. It was only to the Right of Stalin's Communism. The very word "Nazi" is a German abbreviation for "National Socialist" (Nationalsozialist) and the full name of Hitler's political party (translated) was "The National Socialist German Workers' Party" (In German: Nationalsozialistische Deutsche Arbeiterpartei)

****************************

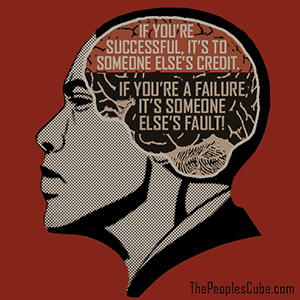

The dark side of Obama's statement: collective achievement equals collective punishment

As Obama's "you didn't build that" quote is being probed and analyzed, I'd like to point out that the idea of redistributing other people's achievements is only a tip of an enormous ideological iceberg. Its invisible foundation sinks deep into the murky depths underneath the floating wreckage of American values.

Lest we take Obama's words out of context and are accused of "swift-quoting," let's review the full passage. Speaking at a campaign stop in Roanoke, Va., on July 13th, Barack Obama said:

"If you were successful, somebody along the line gave you some help. There was a great teacher somewhere in your life. Somebody helped to create this unbelievable American system that we have that allowed you to thrive. Somebody invested in roads and bridges. If you've got a business, you didn't build that. Somebody else made that happen. The Internet didn't get invented on its own. Government research created the Internet so that all the companies could make money off the Internet. The point is, when we succeed, we succeed because of our individual initiative, but also because we do things together."

A friend with a PhD in mathematics made this comment: "We scientists say that in order to make an apple pie from scratch, you must first build the universe - and that takes about four billion years. But that doesn't mean we can't build anything new from existing resources. So telling a businessman 'you didn't build that' is pure sophistry. Such phrases have always been a preamble to looting. Coming from the President, it's chilling."

Now let's put on our intellectual scuba gear to explore what lies beneath Obama's superficial altruistic bragging, which until now has served him as an unsinkable platform.

Apart from the simple untruth that "government created the Internet," Obama's words boil down to the old collectivist bromide that the individual is nothing without the society and the state. As one would expect, Obama didn't come up with it on his own. Standing on the shoulders of his collectivist predecessors, he ineptly restated Mussolini's motto: "All individuals or groups are relative, only to be conceived in their relation to the State." And Benito's fellow collectivist Adolf Hitler agrees: "Our nation can achieve permanent health only from within on the basis of the principle: The common interest before self-interest."

If the businessman "didn't build that," who did? Apparently, all of us did! And if the credit is equally shared, so must be the reward. Jackpot winners all! No more worries about paying the mortgage or filling the gas tank. This must be what thrilled Obama's voters during the 2008 election, as his speeches removed old moral barriers protecting other people's property and made it available to all, establishing a new morality of forced redistribution of wealth, previously known as looting.

But here's the catch: everything in this world has a price. If all of us can be credited for someone else's achievement, by the same logic, all of us can be punished for someone else's failure. Just as all individual credit goes to the society as a whole, so does all the blame. And if the entire group, class, nation, or race can gain moral authority because some of its members did something right, the same standard grants the moral authority to blame any other group, class, nation, or race because some of its members did something wrong. In the history of collectivism this concept translated into wars, slavery, pogroms, terrorism, ethnic cleansing, expropriation of wealth, deportation, internment, resettlement, and genocide.

It appears that the two notions, collective achievement and collective punishment, are as inseparable as two sides of the same coin.

But there's more: if nothing is to your credit, then nothing is your fault. What is the cost of that bargain? In a seemingly fair trade-off, we lose our right to individual achievements but gain the right to blame others for our failures. Collectivism provides us with a sufficiently analgesic illusion of fairness. If you turn out to be a loser, it's not because you are unqualified: on a whim, with objective standards removed, you can now self-righteously put the blame on those close to you, or on the unfair system, or even on the big wide (and deeply flawed) world.

Before you know it, your moral impulses are reduced to an immature tantrum of a toddler who breaks things and hits a babysitter; a teenager who curses at his family and blames the Universe for his pimples; a graduating student of Marxism at the Occupy Wall Street encampment who vandalizes private property and blames capitalism for not providing him with a high-income job; an aging member of the "drug revolution" who blames The Man and The System for his depression; or the President of the United States whoblames corporations and bank CEOs, modern technology and "messy democracy," Fox News and all other media, the Japanese tsunami and the Arab Spring, as well as Bush, Reagan, Congress, the GOP, and the entire city of Washington for his lack of achievement.

Coincidentally, such is also the moral foundation of collectivist societies, from Cargo Cult followers to the so-called People's Democracies. In the erstwhile USSR, the government redistributed not only the nation's dwindling wealth; it redistributed successes and failures. All achievements were credited to the Party and its leaders, as well as to a centrally appointed regiment of "Heroes of Socialist Labor," who conspicuously "sacrificed for the common good." The failures were blamed on foreign aggressors, Western imperialism, enemies of the people, kulaks, saboteurs, corrupt bureaucracy, irresponsible middle management, selfish greed, and lack of proletariat consciousness, as well as on natural disasters and bad weather. Sound familiar?

Find the guilty and the opportunistic politicians will come. The problem is, they come not to help you but to help themselves. The latest example is the current grievance-mongering U.S. government - a massive self-serving army of patented demagogues who have yet to improve one life or right a single wrong. In the final analysis, collectivism is a dead end. Releasing the floodgates of government corruption is only Act One in the drama of a declining nation.

Now that we have gotten to the bottom of it, let's review Obama's quote from this new perspective:

"If you have failed, somebody along the line ruined it for you. There was a lousy teacher somewhere in your life. Somebody helped to create this unfair American system that caused you to fail. Somebody benefitted from your demise. If you're a loser, it's not your fault. Somebody else made that happen. Titanic didn't sink on its own. Corporations and insurance companies made a lot of money off of it, so they must be complicit. The point is, when we fail, we fail not only because of our individual shortcomings, but also because others have teamed up behind your backs. Vote for me - I'll punish the guilty and give you what's rightfully yours."

It turns out that, after all, "someone else made that happen" is merely a flipside of "blame someone else." One can't exist without the other.

In contrast, the argument for individualism and competitive private enterprise cannot be "flipped" - not without distorting its nature and moral purpose. The statement, "It's my achievement and I have the right to what I earn," manifests only positive, objectively true human values.

Unlike its alternatives, capitalism doesn't grow out of a dark, indiscernible mass of moral entanglements. And unlike crony capitalism - a corrupt monster created by government intrusion into the economy - free market capitalism is transparent. Just like the greatest invention of our time, the personal computer (brought to us by free enterprise), capitalism has a user-friendly interface: WHAT YOU SEE IS WHAT YOU GET.

SOURCE

*******************************

Chik-fil-A-Quake: What the Media Didn't Say

If the media reports an earthquake was a breeze in the forest, did the earth still move? I’m not sure TownHall Finance is the natural venue for that question, but I’m also not sure why the Denver Post—my local paper—put a significant political and cultural event on page umpty-something, in the business section.

If you didn’t see it with your own eyes, you might have missed something big last week. Under fire by gay activists and their media amplifiers, Chick-fil-A CEO Dan Cathy unapologetically confirmed he supports the biblical definition of family as he understands it. This modern heresy quickly went viral. Reaction was harsh. Big city mayors and councilors channeled Al Capone with a badge: “Don’t file no stinking permit applications in our town, Chick-fil-A!” Pundits nodded righteously. But, what happened next didn’t follow the script.

Backlash welled up, not just from social conservatives, but fiscal conservatives and libertarians, outraged that politicians would trample the First Amendment, brandishing political litmus tests for the right to do business. Social media and web commentary buzzed with rebellion. A great day of fried chicken and Chick-fil-A appreciation was proposed.

Last Wednesday, I met friends in north suburban Denver at about 11 to beat the rush. Fail. The lot was packed, the drive-thru and building tightly coiled by a boa of cars, tail extending to the street. Inside was standing room only, with a switch-back line that triggered post-Disney traumatic stress. Yet, amid the din, cheer was high. The besieged staff moved helpfully and efficiently, and the line shuffled like a smooth deck of cards.

The friendly mob cycled through, holding steady in size the hour I was there. Judging scientifically by anecdotal Facebook posts, it stayed that way all day and evening, at every Chick-fil-A around Denver, throughout the state, and across the nation. The outpouring was unforeseen, the magnitude unimaginable. The chain’s coffers got a short- and probably long-term boost.

After 20 years around politics, I’ve seen how activists can generate pretty good ink just from a press release and 50 people on the Capitol steps in front of a borrowed guitar amplifier. I also know how hard groups sometimes have to hustle to assemble their 50. So I was eager to see what the media would make of this human tide.

Thursday’s Denver Post business page answered: “Coloradans voice their opinions on Chick-fil-A; Outlets flooded by supporters and opponents.” Not even close. Without space to fully deconstruct, I’ll acknowledge the article did say the crowds were large and the protesters few. But the headline and details caught maybe half the story and missed the essence. A few thoughts, on the event and the coverage:

Especially without any central organizer or major media promotion, the numbers were staggering, and broadly replicated across the country. If a protest warrants a story, this event deserves a Pulitzer-nominated multi-part investigative series.

It wasn’t a forum about the First Amendment, Cathy’s marriage views, or even political bullying. Whatever their motivation, the crowd arrived as a smiling, hungry lunch and dinner crew. It was a massive show of implicit support and protest, for reasons that deserve examination.

My table included a friend who supports civil unions, one for gay marriage, and one who thinks government should get out of the marriage business, letting people and churches make their own agreeable arrangements. We didn’t discuss the fourth person’s view, or anyone else’s that day, because lunch was don’t ask don’t tell.

It’s clear many diners intended to rebuke bullying politicians and the un-American idea that approved political views are required for permission to be in business. Does this resentment go further, and reflect anger at transgressed lines between private and public management, corporate and government bedfellows sharing money, policies, and favors? Is that resentment building toward a November eruptian?

Another strong positive is rejection of a vicious double standard: One side airs views through a respectful media, while others get vilified for different opinions. It’s breathtaking that liberals seek to redefine fundamental cultural concepts and muzzle the opposition; those who question or disagree should be attacked and cowed into silence, even while they speak for majority opinion. That happened with California’s ballot measure on marriage, as more than one financial supporter was hounded from high profile jobs. Wednesday was a salutary fist at that ugly trend.

Finally, what to make of the subdued coverage. Did our scribes not recognize an important cultural moment? Because it doesn’t interest them or flatter their vision? That’s the fish-don’t-know-they’re-wet view of media bias. Or, do they know full well and work carefully to contain the story? Of course, either way, the effect is the same.

SOURCE

*******************************

ELSEWHERE

Social Security not deal it once was for workers: "People retiring today are part of the first generation of workers who have paid more in Social Security taxes during their careers than they will receive in benefits after they retire. It's a historic shift that will only get worse for future retirees, according to an analysis by The Associated Press. Previous generations got a much better bargain, mainly because payroll taxes were very low when Social Security was enacted in the 1930s and remained so for decades."

Obama's fake birth certificate and other stories that don’t get covered: "Based in Washington, D.C., Diana West writes a weekly column nationally syndicated by the Universal Press Syndicate in Kansas City. It's a courageous column tackling topics seldom broached in the pages of many mainstream dailies. ... 'You're not being paranoid, it's absolutely true,' Ms. West replied. 'For a journalist, the comfort zone of discussable topics is definitely shrinking.'"

Why we shouldn’t tax companies: Because companies don’t pay taxes: "It's not unusual to hear the economically illiterate insisting that companies must pay more in taxes. This is illiterate because companies do not pay taxes. They cannot, for only people can bear the burden of a tax: someone's wallet has to get lighter and that wallet must belong to a person."

Counsel of despair?: "Over the years, I have heard many people say that the government’s adoption of a laissez-faire stance during a business recession or depression amounts to 'do-nothing government' -- the unstated assumption always being that it is better for the government to 'do something' than to do nothing. Recommending such a hands-off stance is often described as a 'counsel of despair.' Moreover, it is frequently added, in a democratic polity, the electorate will not tolerate such a policy. Implicit in such criticism is the assumption that the government knows how to improve the situation and has an incentive to do so."

Government Motors goes subprime: "President Obama continues pointing to his crony bankruptcy bailout of GM as a success. ... Now it turns out that much of the recent sales growth GM has bragged about is due to GM jacking up its sales with subprime loans."

Parenting bill could split baby many ways: "State Sen. Mark Leno wants California to recognize that a child can have 'more than two legal parents.' So he wrote a bill, SB1476, which, he argues, doesn't change the definition of a parent (for example, live-in lovers would not qualify) but allows family court to recognize more than two parents only 'when it is required to be in the best interest of the child.' He stresses that if the bill becomes law, 'None of our sponsors or supporters believe that this authority will be used very often.' SB1476 is for rare cases, Leno argues, like baby M.C., as she is known in court documents."

Obama shows what he thinks of the military: "In a move that puts new meaning to the term battleground, President Obama's re-election campaign and members of some military groups are on a collision course over voting rights in the critical state of Ohio. The Obama campaign and the Democratic National Committee have filed a lawsuit to block a new state law allowing men and women in uniform to vote up until the Monday right before an election, while the cutoff on early voting for the rest of the public is three days earlier. Men and women in uniform typically get more time than other voters to send in absentee ballots since they may be serving in an overseas or domestic location that is not close to their home polling station."

*****************************

My Twitter.com identity: jonjayray. I have deleted my old Facebook page as I rarely accessed it. For more blog postings from me, see TONGUE-TIED, EDUCATION WATCH INTERNATIONAL, GREENIE WATCH, POLITICAL CORRECTNESS WATCH, GUN WATCH, FOOD & HEALTH SKEPTIC, AUSTRALIAN POLITICS, IMMIGRATION WATCH INTERNATIONAL, EYE ON BRITAIN and Paralipomena

List of backup or "mirror" sites here or here -- for readers in China or for everyone when blogspot is "down" or failing to update. Email me here (Hotmail address). My Home Pages are here (Academic) or here (Pictorial) or here (Personal)

****************************

The Big Lie of the late 20th century was that Nazism was Rightist. It was in fact typical of the Leftism of its day. It was only to the Right of Stalin's Communism. The very word "Nazi" is a German abbreviation for "National Socialist" (Nationalsozialist) and the full name of Hitler's political party (translated) was "The National Socialist German Workers' Party" (In German: Nationalsozialistische Deutsche Arbeiterpartei)

****************************

Monday, August 06, 2012

Picture gallery

Every six months or so I put up a picture gallery consisting of what I think are the "best" pictures that have appeared on my various blogs. The January to June, 2012 gallery is accessible here.

***********************

Ron Unz and IQ

I seem to be a consistent critic of Ron Unz, editor of "The American Conservative". I noted yesterday (and earlier) that his idea of low criminality among Hispanics is contradicted by Obama's deportation statistics and I also took a few potshots at his theory that IQ differences between nations are mostly the effect of environmental factors.

So I am pleased that Richard Lynn has now given a systematic reply to Unz on the IQ question. Lynn echoes some of the points I made (and I did get an email from Lynn saying he liked my article) but his reply is far more detailed and scholarly and, I think, a good reply to Unz's claims.

Unz has replied to Lynn and it looks to me that the two sides are converging, with the differences being in matters of degree. Both parties agree that the environment has some influence but Lynn makes a strong case for the importance of genetics.

***************************

Could a brain scan tell you how smart you are? Research shows intelligence linked to strength of neural connections

More evidence that IQ is genetically determined. We are now getting an idea of the specific mechanisms involved

Research suggests that 10 per cent of individual differences in intelligence can be explained by the strength of neural pathways connecting the left lateral prefrontal cortex to the rest of the brain.

The findings, published in the Journal of Neuroscience, establish 'global brain connectivity' as a new approach for understanding how human intelligence relates to physiology.

'Our research shows that connectivity with a particular part of the prefrontal cortex can predict how intelligent someone is,' said Michael Cole, PhD, a postdoctoral research fellow in cognitive neuroscience at Washington University and lead author of the study.

He says the research is the first to provide compelling evidence that neural connections between the lateral prefrontal cortex and the rest of the brain make a unique and powerful contribution to the cognitive processing underlying human intelligence.

'This study suggests that part of what it means to be intelligent is having a lateral prefrontal cortex that does its job well; and part of what that means is that it can effectively communicate with the rest of the brain,' added study co-author Todd Braver, PhD, professor of psychology in Arts & Sciences and of neuroscience and radiology in the School of Medicine.

One possible explanation of the findings, the research team suggests, is that the lateral prefrontal region is a 'flexible hub' that uses its connectivity to monitor and influence other brain regions.

'There is evidence that the lateral prefrontal cortex is the brain region that "remembers" the goals and instructions that help you keep doing what is needed when you're working on a task,' said Prof Cole. 'So it makes sense that having this region communicating effectively with other regions (the "perceivers" and "doers" of the brain) would help you to accomplish tasks intelligently.'

While other regions of the brain make their own special contribution to cognitive processing, it is the lateral prefrontal cortex that helps coordinate these processes and maintain focus on the task at hand. This happens in much the same way that the conductor of a symphony monitors and tweaks the real-time performance of an orchestra.

The findings are based on an analysis of functional magnetic resonance (fMRI) brain images captured as study participants rested passively and also when they were engaged in a series of mentally challenging tasks associated with fluid intelligence, such as indicating whether a currently displayed image was the same as one displayed three images ago.

Previous findings relating lateral prefrontal cortex activity to challenging task performance were supported. Connectivity was then assessed while participants rested, and their performance on additional tests of fluid intelligence and cognitive control collected outside the brain scanner was associated with the estimated connectivity.

Results indicate that levels of global brain connectivity with a part of the left lateral prefrontal cortex serve as a strong predictor of both fluid intelligence and cognitive control abilities.

More HERE

****************************

Another revealing admission of Leftist motivations

I don't think Leftists realize how arrogant they sound sometimes. Obama is on record as wanting to "fundamentally reshape" the American economy -- something he has certainly done, though not in a way that many would praise -- and we read below something very similar from Kevin Rudd, a past Prime Minister of Australia who could well be getting his job back soon as his Leftist rivals falter. There are no fixed terms for Australian Prime Ministers.

In reading Leftist admissions of wanting to "reshape" countries conservatives ask: What if the people don't want the shape the Leftist wants? What about letting the people shape their nation by their own individual actions and choices? This idea that a "shape" can be imposed from on high is pure Fascism

He is not supposed to be talking about a comeback, but former prime minister Kevin Rudd has given an interview in which he opens up about wanting to shape Australia's future well into the next decade.

Mr Rudd, who unsuccessfully challenged Julia Gillard for the Labor leadership in February, has told the Australian Women's Weekly that shaping the nation - which is somewhat difficult to do from the backbench - is "part of who I am, and you gotta be who you are".

Asked directly whether he wanted an ongoing role for himself, Mr Rudd said: "Oh definitely, it's just who I am. You gotta be who you are."

He was quick to say that "the position you occupy in life is less important". "What's more important is being involved directly in shaping the nation's future, to the extent that you can," he said.

More HERE

***************************

Obama's reliance on ignorance

Calculated Deception. That is the central theme of the Obama campaign. Calculated Deception is the term I use for Obama's rhetorical practice of trying to take advantage of what he calculates the average person does not know, and his party-controlled, so-called mainstream media won't report. And that can be seen over and over in the Obama campaign.

In Monday's Wall Street Journal, Edward Lazear, former Bush chairman of the President's Council of Economic Advisors, notes, "A graph titled 'Private Sector Job Creation' on the Obama-Biden campaign website... announces proudly that 4.4 million private sector jobs have been created over the past 28 months." But that factoid is meaningless out of any context, more like a pediatrician boasting to you that under his care your 16-year-old son has grown to 4 feet 4 inches. At the same point during the Reagan recovery, the economy had created 9.5 million new jobs.

Moreover, Lazear correctly adds, "there hasn't been one day during the entire Obama presidency when as many Americans were working as on the day President Bush left office." That's right, contrary to the Obama campaign's misleading claim of 4.4 million new jobs created, total jobs today are still half a million less than in January 2009 when Obama entered office.

Lazear continues, "Moreover, the unemployment rate, which we were told would not exceed 8% if we enacted Mr. Obama's stimulus package...has never fallen below 8% during his presidency. The rate has averaged 9.2% since February 2009." In sharp contrast, after Bush's tax rate cuts were all fully implemented in 2003, the economy created 7.8 million new jobs over the next 4 years and the unemployment rate fell from over 6% to 4.4%. We won't see that again until Obama is out of office.

President Obama and his chairman of the Council of Economic Advisors, Alan Krueger, brag that private sector jobs have now grown for "28 straight months." Obama and Krueger apparently think most Americans do not know that job growth is the norm and not the exception for the American economy. In the 62 years from January 1946, after World War II, until January 2008, jobs grew in 86% of the months, or 640 out of 744. Reagan's recovery produced job growth in 81 out of its first 82 months, with 20 million new jobs created over those 7 years, increasing the civilian workforce at the time by 20%. Even George W. Bush oversaw 52 consecutive months of job growth, including nearly 8 million new jobs created after his 2003 capital gains and dividends tax rate cuts became effective (which Obama is dedicated to reversing).

The relevant streak of Obamanomics was extended in the June jobs report. That report established that under President Obama America has suffered 41 straight months of unemployment over 8%, which the Joint Economic Committee of Congress confirms is the worst recovery from a recession since the Great Depression almost 75 years ago. Indeed, the last time before Obama unemployment was even over 8% was December 1983, when Reaganomics was bringing it down from the Keynesian fiasco of the 1970s. It didn't climb back above that level for 25 years, a generation, which is a measure of the spectacular success of Reaganomics.

But Krueger tells us about that June jobs report, "It is important not to read too much into any one monthly report." The Obama Administration, however, has said the exact same thing for each of the last 30 months, as documented July 6 by Bryan Preston for PJMedia.

President Obama keeps telling us his economic program should be judged by comparison to the worst of the recession. Look, we have turned the corner, he says, and the economy has started growing again, just like your teenage son. But the correct comparison is to prior recoveries from past recessions. As Lazear explained, "Yet we know that all recessions end and that labor markets recover eventually. What distinguishes this labor-market recovery is not that jobs are finally being created but rather the growth rate is so slow that it will be 2016 before we return to pre-recession employment levels." Obama is campaigning as if he were certain that a majority of Americans do not know that all recessions end and that labor markets recover eventually.

American recessions since the Great Depression previously have lasted an average of 10 months, with the longest at 16 months. But this latest recession began in December 2007. The June labor report showed that the most commonly cited U3 unemployment rate remains stuck at 8.2%, with the number of unemployed Americans actually rising over the last 3 months by 76,000, 54 months after the recession started, and 3 years after it was supposedly over, the longest period of unemployment that high since the Great Depression.

Barack Obama knows that history, even though he is sure a majority of you don't. That is why he was confident enough to tell Matt Lauer and the nation in February 2009 regarding economic recovery: "If I don't have that done in three years, then this is going to be a one-term proposition." And it is why the Administration so confidently labeled the summer of 2010 "Recovery Summer," as by historical standards the recovery was already way overdue by then.

Obama's tragic jobs record reflects the dismal economic growth under his administration's throwback, Keynesian economic policies. For all of last year, the economy grew by a paltry real rate of 1.7%, only about half America's long-term trend. The average so far this year has been no better. That dismal growth is further reflected in the Census Bureau reports of falling real wages under Obama, kicking median family income back over 10 years, with more Americans in poverty today than at any time in the more than 50 years that Census has been tracking poverty.

In sharp contrast, in the second year of Reagan's recovery, the economy boomed by a real rate of 6.8%, the highest in 50 years. Real per capita disposable income increased by 18% from 1982 to 1989, meaning the American standard of living increased by almost 20% in those first 7 years of the Reagan boom alone. The poverty rate, which had started increasing during the Carter years, declined every year from 1984 to 1989, dropping by one-sixth from its peak. That is the proper comparison for Obama's economic performance.

More HERE

*************************

ELSEWHERE

Part of a large vote against homosexual "marriage": "Thousands flocked to local Chick-fil-A restaurants to show support for owner Dan Cathy’s controversial statements on same-sex marriage. Cathy’s statements have been the focus of many media groups leading up to the unofficial establishment of Chick-fil-A appreciation day Wednesday by former Arkansas Gov. and 2008 presidential candidate Mike Huckabee. In Shreveport, so many customers came out to support the privately owned fast-food establishment that the Chick-fil-A on Youree Drive was forced to close its doors just after 5 p.m. for lack of chicken. The Chick-fil-A on Airline Drive in Bossier City also had incredible business but managed not to sell out, as folks waited 30 minutes or longer to get their nuggets. Even Bossier City police were on hand to direct traffic as the drive-through lane stretched past neighboring businesses and bridged several parking lots."

NY: Activists push city to be first in US to prohibit use of drones: "The City of Buffalo has a chance to be the first in the country to ban Unmanned Aerial Vehicles, also known as drones. A group of activists and community leaders came to City Hall on Tuesday to have their say in front of the Common Council Legislation Committee. 'You guys have an opportunity to make Buffalo the first drone-free city in the United States, and I hope you take that seriously,' John Washington of Occupy Buffalo told lawmakers." (08/01/12)

CA: San Bernardino files for bankruptcy: "A California city filed for bankruptcy Wednesday, the third in the Golden State to do so in recent weeks, stoking experts' concerns that other cities could follow suit. The city of San Bernardino, with more than 200,000 residents on the eastern tip of greater Los Angeles, 'filed an emergency petition for Chapter 9 Bankruptcy' with a regional U.S. bankruptcy court, according to a news release from the city's interim manager."

We need separation of medicine and state: "The federal government, in general, and the Food and Drug Administration, in particular, increasingly inject themselves into direct control of every medical practice. The FDA is aggressively moving past its sole jurisdiction over the approval of every medication and all medical equipment. It now seeks control of perhaps every procedure and treatment that your physician recommends. The FDA issued a warning (i.e., threat) about the use of venal catheters as a result of a physician conducting a clinical trial for treatment of multiple sclerosis. After approving the safety and efficacy of the device, the FDA now requires that it approve every use by individual physicians"

No taxation without respiration!: "This week, the House of Representatives will take up a tax extenders package to prevent the Bush tax cuts of ’01 and ’03 from expiring at the end of the year. Earlier this month, C4L called on the House Ways & Means Committee to include full repeal of the estate tax (AKA -- the death tax) in their tax package."

There is a new lot of postings by Chris Brand just up -- on his usual vastly "incorrect" themes of race, genes, IQ etc.

*****************************

My Twitter.com identity: jonjayray. I have deleted my old Facebook page as I rarely accessed it. For more blog postings from me, see TONGUE-TIED, EDUCATION WATCH INTERNATIONAL, GREENIE WATCH, POLITICAL CORRECTNESS WATCH, GUN WATCH, FOOD & HEALTH SKEPTIC, AUSTRALIAN POLITICS, IMMIGRATION WATCH INTERNATIONAL, EYE ON BRITAIN and Paralipomena

List of backup or "mirror" sites here or here -- for readers in China or for everyone when blogspot is "down" or failing to update. Email me here (Hotmail address). My Home Pages are here (Academic) or here (Pictorial) or here (Personal)

****************************

The Big Lie of the late 20th century was that Nazism was Rightist. It was in fact typical of the Leftism of its day. It was only to the Right of Stalin's Communism. The very word "Nazi" is a German abbreviation for "National Socialist" (Nationalsozialist) and the full name of Hitler's political party (translated) was "The National Socialist German Workers' Party" (In German: Nationalsozialistische Deutsche Arbeiterpartei)

****************************

Every six months or so I put up a picture gallery consisting of what I think are the "best" pictures that have appeared on my various blogs. The January to June, 2012 gallery is accessible here.

***********************

Ron Unz and IQ

I seem to be a consistent critic of Ron Unz, editor of "The American Conservative". I noted yesterday (and earlier) that his idea of low criminality among Hispanics is contradicted by Obama's deportation statistics and I also took a few potshots at his theory that IQ differences between nations are mostly the effect of environmental factors.

So I am pleased that Richard Lynn has now given a systematic reply to Unz on the IQ question. Lynn echoes some of the points I made (and I did get an email from Lynn saying he liked my article) but his reply is far more detailed and scholarly and, I think, a good reply to Unz's claims.

Unz has replied to Lynn and it looks to me that the two sides are converging, with the differences being in matters of degree. Both parties agree that the environment has some influence but Lynn makes a strong case for the importance of genetics.

***************************

Could a brain scan tell you how smart you are? Research shows intelligence linked to strength of neural connections

More evidence that IQ is genetically determined. We are now getting an idea of the specific mechanisms involved

Research suggests that 10 per cent of individual differences in intelligence can be explained by the strength of neural pathways connecting the left lateral prefrontal cortex to the rest of the brain.

The findings, published in the Journal of Neuroscience, establish 'global brain connectivity' as a new approach for understanding how human intelligence relates to physiology.

'Our research shows that connectivity with a particular part of the prefrontal cortex can predict how intelligent someone is,' said Michael Cole, PhD, a postdoctoral research fellow in cognitive neuroscience at Washington University and lead author of the study.

He says the research is the first to provide compelling evidence that neural connections between the lateral prefrontal cortex and the rest of the brain make a unique and powerful contribution to the cognitive processing underlying human intelligence.

'This study suggests that part of what it means to be intelligent is having a lateral prefrontal cortex that does its job well; and part of what that means is that it can effectively communicate with the rest of the brain,' added study co-author Todd Braver, PhD, professor of psychology in Arts & Sciences and of neuroscience and radiology in the School of Medicine.

One possible explanation of the findings, the research team suggests, is that the lateral prefrontal region is a 'flexible hub' that uses its connectivity to monitor and influence other brain regions.

'There is evidence that the lateral prefrontal cortex is the brain region that "remembers" the goals and instructions that help you keep doing what is needed when you're working on a task,' said Prof Cole. 'So it makes sense that having this region communicating effectively with other regions (the "perceivers" and "doers" of the brain) would help you to accomplish tasks intelligently.'

While other regions of the brain make their own special contribution to cognitive processing, it is the lateral prefrontal cortex that helps coordinate these processes and maintain focus on the task at hand. This happens in much the same way that the conductor of a symphony monitors and tweaks the real-time performance of an orchestra.

The findings are based on an analysis of functional magnetic resonance (fMRI) brain images captured as study participants rested passively and also when they were engaged in a series of mentally challenging tasks associated with fluid intelligence, such as indicating whether a currently displayed image was the same as one displayed three images ago.

Previous findings relating lateral prefrontal cortex activity to challenging task performance were supported. Connectivity was then assessed while participants rested, and their performance on additional tests of fluid intelligence and cognitive control collected outside the brain scanner was associated with the estimated connectivity.

Results indicate that levels of global brain connectivity with a part of the left lateral prefrontal cortex serve as a strong predictor of both fluid intelligence and cognitive control abilities.

More HERE

****************************

Another revealing admission of Leftist motivations

I don't think Leftists realize how arrogant they sound sometimes. Obama is on record as wanting to "fundamentally reshape" the American economy -- something he has certainly done, though not in a way that many would praise -- and we read below something very similar from Kevin Rudd, a past Prime Minister of Australia who could well be getting his job back soon as his Leftist rivals falter. There are no fixed terms for Australian Prime Ministers.

In reading Leftist admissions of wanting to "reshape" countries conservatives ask: What if the people don't want the shape the Leftist wants? What about letting the people shape their nation by their own individual actions and choices? This idea that a "shape" can be imposed from on high is pure Fascism

He is not supposed to be talking about a comeback, but former prime minister Kevin Rudd has given an interview in which he opens up about wanting to shape Australia's future well into the next decade.

Mr Rudd, who unsuccessfully challenged Julia Gillard for the Labor leadership in February, has told the Australian Women's Weekly that shaping the nation - which is somewhat difficult to do from the backbench - is "part of who I am, and you gotta be who you are".

Asked directly whether he wanted an ongoing role for himself, Mr Rudd said: "Oh definitely, it's just who I am. You gotta be who you are."

He was quick to say that "the position you occupy in life is less important". "What's more important is being involved directly in shaping the nation's future, to the extent that you can," he said.

More HERE

***************************

Obama's reliance on ignorance

Calculated Deception. That is the central theme of the Obama campaign. Calculated Deception is the term I use for Obama's rhetorical practice of trying to take advantage of what he calculates the average person does not know, and his party-controlled, so-called mainstream media won't report. And that can be seen over and over in the Obama campaign.