All over America ....

***********************

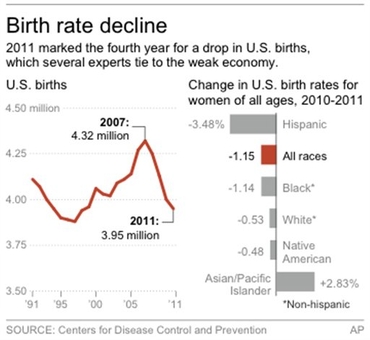

The baby bust generation

Jeff Jacoby points out some rather disturbing facts below but a note of caution is in order. Birth rates vary considerably from year to year so to take the present rate as a prediction for the future would be foolish. It is quite possible that what is happening is a filtering out of non-maternal women from the population and once that is done the birthrate among the remaining women may be quite high

FERTILITY IN AMERICA has been declining for years. According to the Pew Research Center, the nation's birth rate hit an all-time low in 2011 – just 63 births per 1,000 women of childbearing age. It was almost twice as high – 123 births per 1,000 women – at the peak of the Baby Boom in 1957.

As babies and children disappear from a society, what takes their place? One answer, as journalist Jonathan V. Last observes in a forthcoming book, "What to Expect When No One's Expecting," is pets.

In surveys taken from the 1940s to the 1980s, fewer than half of Americans said they owned a pet. Today America's 300 million humans own 360 million pets. Last puts that in perspective: "American pets now outnumber American children by more than four to one." Often those pets are pampered to a degree that quite recently would have been thought eccentric. The average dog-owning household's spending on pet grooming aids, for example, more than doubled between 1998 and 2006. Last notes that when a kids' clothing store in the suburban Washington neighborhood where he used to live went out of business, it was replaced by a doggie spa – leaving the neighborhood "with six luxury pet stores and only two shops dedicated to clothing children."

A mania for pets isn't all that materializes when the birth rate sinks. So do economic stagnation, dwindling innovation, a declining lifestyle, the exploding health and pension costs of an aging population, and the ever-heavier taxes needed to maintain the government safety net when there are fewer workers and entrepreneurs. Optimism, booming markets, and technological dynamism recede, supplanted by intergenerational conflict and loneliness.

Many people, it's true, are still in the grip of the Malthusian fallacy. The superstition that that the Earth is already too full, and that more human beings will mean more hunger, misery, and environmental despoliation, is a popular one. But serious demographers, economists, and others have been warning for years that declining populations lead to shortages, misery, and upheaval.

"If you think that population decline is going to be a net boon to society," Megan McArdle writes in the Daily Beast, "take a long hard look at Greece. That's what a country looks like when it becomes inevitable that the future will be poorer than the past: social breakdown, political breakdown, economic catastrophe."

If so, Greece will have plenty of company. Fertility rates are falling everywhere. The median age in many countries is already over 40, well above the prime childbearing years. In some places, plummeting fertility can be attributed to dictatorial coercion: To enforce its "One-Child" policy, China has employed methods ranging from steep fines and loss of employment to compulsory sterilization and abortions. The results have been brutal: Hundreds of millions of births have been prevented, China's median age is at 36 and rising, and the Chinese fertility rate is now 1.54 – well below the rate of 2.1 needed to maintain a steady population.

But as Last points out, the fertility rate for white, college-educated American women – a proxy for the US middle class – is 1.6. "In other words, America has created its very own 'One-Child' policy. It's soft and unintentional, the result of accidents of history and thousands of little choices. But it has been just as effective."

It is hard to overstate the demographic and social transformation this represents. It wasn't that long ago that getting married and having children were life goals shared by nearly every American. For most of the 20th century, well over 90 percent of US adults married at some point in their lives – at one point the percentage went as high as 98.3 percent. Now, according to Pew, barely half of all adults in the United States – a record low – are married. And nearly 4 in 10 Americans say marriage is becoming obsolete.

And as more people choose not to marry, more of them retreat from childrearing. For decades Gallup has asked Americans what they consider the "ideal family size." From the 1940s to the 1960s, roughly 70 percent said that three or more children would be best. But beginning in the late 1960s, the American "ideal" fell sharply. Today only 33 percent of Americans regard three or more kids as desirable. And in practice, one in five American women now have no children at all.

What happens to a society that increasingly turns its back on marriage and babies? In which singlehood becomes standard, and pets outnumber kids by four to one? Ready or not, America is going to find out.

SOURCE

***************************

Donations Pour in to Help Black Hot Dog Vendor After Union Goons Destroyed His Supplies

Clint Tarver’s hot dog stand was destroyed during protests over the passage of Right to Work legislation at Michigan’s state capitol building last week. As Kate reported, Tarver was not involved in the protests but was hired by Americans for Prosperity to cater their tent as they counter-protested. As union thugs tore down AFP’s tent, they also destroyed Tarver’s equipment and called him an “Uncle Tom” among other racial slurs.

“The Hot Dog Guy’s” luck has turned around, however. A staff member for a local lawmaker set up an online fundraiser for Tarver and as of Friday, more than $33,000 has been donated.

“I’m overwhelmed,” Tarver said Friday. “The public has shown such love to me. You never know your true friends until you get down and I’ve had people I thought were pretty close to me and they’ve given me one call. You learn from your endeavors.”

Lorilea Zabadal, a staff member for Republican state Rep. Al Pscholka, established the fundraiser after learning of Tarver’s plight.

“Everyone who has passed the hot dog cart knows what a kind and caring individual Clint is,” Zabadal wrote. “He never fails to bestow a smile or friendly greeting. In no way [did] he provoke this attack, nor any of the behavior displayed toward him. Regardless of your position on current legislation, rebuilding Clint's Hot Dogs is something we can all support. Please give what you can to get this deserving businessman back out there!”

So what will he do with the money?

“First of all, I’m going to get a brand new cart,” he said. “And I have sick sister, so I’m going to help her out and I’m going to help my church too.”

Tarver said Zabadal is a Facebook friend of his wife, Linda. He’s blown away by her unexpected concern, he said.

“Well, she’s a vegetarian and it’s really odd that she started this website for me,” he said. “So there’s going to be a Lorilea hot dog. And it’ll be vegetarian.”

Tarver’s cart will have other new offerings come next spring, although nothing has been finalized as of yet, he said.

“Right now, I’m just thanking everyone for the gifts and love they’ve shown me,” he said. “I’ve forgiven the people who broke all of my stuff. I’ve prayed for them and that’s where I’m at now.”

SOURCE

*******************************

They Never Say "Tax the Successful"

Comedian Adam Carolla has never been one to censor what comes out of his mouth. The gift of gab took him from humble beginnings in economically destitute North Hollywood to dizzying heights inthe entertainment industry, where he could afford to move a few miles away.

It's a story of hard work and success that comes through in his recent book Not Taco Bell Material, a chaotic tour that takes readers from Carolla's early years to how he finally found his calling - and his success.

Carolla's disdain for the politically-correct culture of sensitivity has made him an unlikely but powerful critic of the progressive watering-down of American culture. His first book, In Fifty Years We'll All Be Chicks, was an ode to an era of manliness lost to decades of gender-neutral education. And in recent years, he's lamented the loss of a society that takes responsibility for its actions.

"I made my own luck," Carolla tells Townhall. "I'm the guy who was rejected from Taco Bell," he says, referring his failed application to the fast-food restaurant in his youth that inspired the book's title. "Would you think that guy was born with a four-leaf clover or a rabbit's foot up his butt?"

Thematically, Not Taco Bell Material could be summed up in four words: hard work pays off. It's a mantra espoused by Carolla, from his well-publicized criticisms of the Occupy Wall Street movement to recent comments about the deplorable class warfare deployed by Democrats. "They always say tax 'the rich.'" Carolla says. "Who's 'the rich'? I'm not rich. I'm successful. They never say 'tax the hard-working' or 'tax the successful.' They say 'the rich' because it's easier to deal with their inability to be successful by attributing others' success to luck."

Despite his criticism of the mentality of big-government progressives, Carolla insists his fellow entertainment-industry workers mean well. "Others in Hollywood are very humble. And they say, you know 'I'm very lucky and there are a lot of good actors out of work.' They all know, however, that they worked their tail off to get where they are."

Disdain for the entitlement society has become one of Carolla's distinctions after a rant about Occupy Wall Street went viral last year. "Self-entitled monsters," he called some of the protesters, who "think the world owes them a living."

"It's this envy and shame, and there's gonna be a lot more of it," he said. "Everybody's a winner, there are no losers."

Carolla's own humility comes from his connection with his roots. His retelling of the life story - crazy stories and all - is aided by the fact that he's constantly reminded of it.

"I never left Los Angeles... I probably live three miles from where all those antics took place. I drive past them on an almost-daily basis, which is sort of weird." And despite the adolescent ballbusting and trouble he and his friends got up to, he's stayed true. "I'm happy to say that most all those guys I'm still on great terms with."

SOURCE

*******************************

Wishing You Capitalism on Earth

Katie Kieffer

We wish each other "peace on earth." Wishing is not enough. We must act on this wish by promoting capitalism on earth.

Too many people (including some religious leaders) are promoting the idea that re-distribution of wealth or “social justice” is the best way to foster peace. But Christians and Jews need only read the Old Testament to see that God condemns stealing and envy so much that he gave Moses commandments like: “You shall not steal,” “You shall not covet your neighbor’s wife, and “You shall not covet your neighbor’s goods.”

And in the New Testament, Christ promoted capitalistic ideas. Christ’s allegories conveyed the basic principles of capitalism: freedom, ownership, profit, private property rights, honesty and justice.

How capitalism promotes peace

Men who are trading partners do not typically fight each other. For, they have an economic interest in maintaining friendly relations. And men who are free to pursue vocations that utilize their unique talents will be happier than those who are assigned to work in a specific industry by the state.

In Ayn Rand’s novel, Atlas Shrugged, the federal government takes over all private industry. Dagny Taggart is the heroine whose private railroad company becomes bound and regulated by the federal government. Taggart realizes that socialist public policy has caused her once cheerful employees to loathe her and each other.

Taggart observes: “… she was both a slave and a driver of slaves, and so was every human being in the country, and hatred was the only thing that men could now feel for one another.”

Capitalism thrives on peace; ownership and prosperity encourage individual morality. But socialism thrives on chaos, riots and animosity. Dictators can control people who are poor, hopeless and weak easier than they can control people who are wealthy, confident and powerful. Rand observes in the June 1966 edition of The Objectivist newsletter: “Statism needs war; a free country does not. Statism survives by looting; a free country survives by production.”

Specific action steps

Let me recommend specific action steps we can take to cultivate capitalism on earth:

1.) Trade freely with other countries. For example, I think Iran would deal more openly with our allies like Israel if it had an economic interest in maintaining friendly relations with America. Our current “tactics” of covertly launching cyber attacks (think Stuxnet and Flame) on Iran’s nuclear infrastructure, enforcing extreme economic sanctions and using drones that breach Iran’s national sovereignty are inciting blowback while rendering diplomatic relations unfeasible.

2.) Reduce taxes and regulations. Our high taxes and regulations are encouraging American entrepreneurs to leave this country. (Think billionaire co-founder of Facebook Inc., Eduardo Saverin who renounced his U.S. citizenship in May to become a resident of Singapore.) TIME reports that a record number of American citizens (1,788 in 2011) are relinquishing their U.S. citizenship.

And jobs are leaving too. The world’s most valuable company, Apple, once made its computers in California but now must produce its technology in China in order to turn a profit.

As wealth and jobs flow away from America, it will be difficult for us to remain a peaceful country because we will be susceptible to both civil unrest and outside attacks.

3.) Eliminate the Federal Reserve. This unconstitutional agency is destroying the value of our currency and yoking the markets. And politicians can clandestinely spend money on futile wars because most people will not recognize inflation as a tax until it is too late.

“Ideologically, the principle of individual rights does not permit a man to seek his own livelihood at the point of a gun, inside or outside his country. Economically, wars cost money; in a free economy, where wealth is privately owned, the costs of war come out of the income of private citizens—there is no overblown public treasury to hide that fact—and a citizen cannot hope to recoup his own financial losses (such as taxes or business dislocations or property destruction) by winning the war. Thus his own economic interests are on the side of peace,” writes Ayn Rand in a treatise called “The Roots of War” in The Objectivist.

In other words, capitalism allows men to see the true cost of war because there is no central bank and the federal government does not manipulate the currency and the markets. In this way, capitalism naturally encourages men to avoid war.

Capitalism is the political system that promotes peace because capitalists know that war is inherently opposed to their financial interest and livelihood. During this holy season, let us each think about ways that we can act on our wish for “peace on earth” and promote capitalism in our daily lives.

SOURCE

There is a new lot of postings by Chris Brand just up -- on his usual vastly "incorrect" themes of race, genes, IQ etc.

***************************

For more blog postings from me, see TONGUE-TIED, EDUCATION WATCH INTERNATIONAL, GREENIE WATCH, POLITICAL CORRECTNESS WATCH, FOOD & HEALTH SKEPTIC, AUSTRALIAN POLITICS, IMMIGRATION WATCH INTERNATIONAL, EYE ON BRITAIN and Paralipomena . GUN WATCH is now put together by Dean Weingarten.

List of backup or "mirror" sites here or here -- for when blogspot is "down" or failing to update. Email me here (Hotmail address). My Home Pages are here (Academic) or here (Pictorial) or here (Personal)

****************************

The Big Lie of the late 20th century was that Nazism was Rightist. It was in fact typical of the Leftism of its day. It was only to the Right of Stalin's Communism. The very word "Nazi" is a German abbreviation for "National Socialist" (Nationalsozialist) and the full name of Hitler's political party (translated) was "The National Socialist German Workers' Party" (In German: Nationalsozialistische Deutsche Arbeiterpartei)

****************************