Monday, January 12, 2015

Patriotism

Worldwide, the Left are critical of patriotism. They hate the world they live in and that includes their own country. Most Americans, however, are very patriotic. So Democrat politicians are very defensive about patriotism. Like Leftists everywhere they are not patriotic but in America they dare not admit it. "Are you questioning my patriotism?" Democrat politicians sometimes huff. The correct answer to that would generally be: "Yes". But conservatives are usually too polite to say that.

In England, patriotism has been under elite attack for around a century but it still hangs on. Below is a very patriotic hymn from Britain which is still frequently sung. Note that both the Queen and the (Conservative) Prime Minister are present at the recent performance below in the Royal Albert Hall..

The sentiments are definitely of the "my country right or wrong" sort, which is an uncommon view today. The hymn was written around the time of WWI. One reason why that view no longer prevails is that such a defence was disallowed at the Nuremberg war crimes tribunals immediately after WWII. It was held that German soldiers had a duty to disobey immoral or unethical orders. Just because the orders came from your country's high command was not good enough justification for obeying them. That disobedience to an order in the WWII German armed forces would get you promptly shot did not seem to be considered.

The Nuremberg rules are not however entirely blue sky. The Israeli Defence Force has a "black flag" system. If an officer gives a man what seems an inhumane order, the soldier is duty bound to report that and not to obey the order. It seems to work -- but only because it is taught as part of their military law.

So these days loyalty to your country is mostly based on your country being in the right. And given the chronic feelings of alienation among the Left, it is mainly a conservative virtue.

Leftists, Leftist psychologists particularly, do of course sometimes try to equate patriotism with racism but I carried out an extensive and international research program on exactly that question in the '70s and 80's and found no association between the two attitudes among general populations samples. I know of no subsequent research that has contradicted that. See e.g. here and here and here

Patriotism is of course to be distinguished from nationalism: The feeling that your country has a right to dominate others. You can love your own country while also respecting that other people love theirs. Nationalism seems to have died with Hitler and Tojo's Japan. We do however have a closely related problem: Religious supremacism from Muslims. White and Bushido supremacism may be dead but religious supremacism is very much alive and kicking. It too may eventually need nuclear weapons aimed at selected targets to kill it.

I myself don't much feel great loyalty to one country. I am delighted to have been born and bred in the "Lucky country" but I think the Anglosphere generally has characteristics that I would fight for. Whether I am in Australia, Britain, New Zealand, Canada or the USA I feel I am largely among my own people -- people like me in many ways and whom I readily understand -- and that those people have a good balance in values and in what they collectively regard as important.

Just a small footnote: The name "Lucky country" for Australia, was intended as derogatory by Donald Horne, who invented it. He thought Australia became well-off just out of luck. Australia is however roughly at the centre of Anglospheric variation so by that criterion the whole Anglospere is lucky, which would be lucky indeed, considering their considerable differences in history and geographical location. But that is nonsense. The Anglospheric countries are certainly good places to live -- witness the flood of migration toward them -- but they are good places to live because of the people who live in them -- people who generally have respect for others, who are substantially honest, who tolerate diversity, who respect the rule of law and who are generally peaceful in nature. We make our luck.

********************************

10 Outrageous Examples of Government Regulators Invading Our Lives

10. Federal Censorship Commission. The FCC began considering a petition to revoke the broadcast license of a Washington, D.C., radio station for using the name of the city’s football team, the Redskins. FCC chairman Tom Wheeler declared the moniker “offensive” and urged owner Dan Snyder to change it “voluntarily.” The agency has yet to rule on the petition.

9. April Fool’s Rule. The Volcker Rule prohibits banks from trading securities on their own accounts. The 1,000-page regulation crafted by five federal agencies over three years supposedly remedies one of the causes of the 2008 financial crisis. But there is no evidence to support that claim. That the rule took effect on April Fool’s Day is thus entirely appropriate.

8. The Environmental Protection Agency’s power grab. In its quest to replace cheap and reliable fossil fuels with costly and unreliable “renewables,” the EPA in June unveiled new restrictions on so-called greenhouse gas emissions from existing power plants. These hugely expensive regulations are all the more maddening for accomplishing virtually nothing to affect the climate or protect human health.

7. Uber regulation. The popular ride-sharing service Uber is changing the way Americans get around town. Its fleet of independent drivers offers an efficient alternative to traditional taxis. Yet Uber faces significant hurdles as local regulators try to stop its expansion, claiming that the service is “unfair” to the excessively regulated cab drivers. So far, though, Uber and its loyal customers have fought off those opposing competition, but many hurdles remain.

6. Choking Justice. Woe to any business disfavored by the Department of Justice. Under “Operation Chokepoint,” federal regulators have been leaning hard on banks to end ties with enterprises that the government doesn’t like, including payday lenders, firearms dealers and credit repair services. These businesses are perfectly legal, but the DOJ’s efforts to close them down are not.

5. Halting home financing. New regulations on mortgage financing took effect in January, compliments of Dodd-Frank. Virtually every aspect of financing a home – including mortgage options, eligibility standards, and even the structure and schedule of payments – is now governed by the Consumer Finance Protection Bureau. Alas, critics’ predictions about the restrictions are proving correct: Mortgage lending is running at its lowest level in 13 years, and 2014 will be the worst year for mortgage volume since 2000.

4. Force feeding calorie counts. Knowing the number of calories in various food products does not change our menu choices, several studies have shown. But in keeping with government’s insatiable appetite for control, the Food and Drug Administration in November finalized rules requiring calorie counts to be posted on restaurant menus, supermarket deli cases, vending machines and even in movie theater concessions. Compliance will require tens of millions of hours each year, which is sure to thin consumers’ wallets.

3. Forgetting free speech. In one of the worst public policy decisions in European history (and that’s saying a lot), the European Union ruled in May that links to embarrassing information that is “inadequate, irrelevant or no longer relevant” must be scrubbed from the Internet. Thus, Google must take down that 1975 picture of you dancing in a leisure suit as well as reports on child pornography arrests that regulators deem “irrelevant.” This “right to be forgotten” is a massive violation of free expression in Europe. And it could get worse: The EU is considering applying this gag order worldwide.

2. Polluting the economy. Ozone levels have dropped significantly during the past three decades, reflecting the overall improvement in air quality. Nonetheless, the Environmental Protection Agency has proposed more stringent ozone standards that would cost tens of billions of dollars, making it perhaps the most costly regulation ever imposed. (President Obama pulled a 2011 version for threatening the economy – just as the election neared.)

1. Regulating the Internet. The FCC proposed new rules to require Internet carriers to deliver all online content in a “neutral” fashion. Defining such neutrality is, of course, easier said than done, and doing so without harm to the Internet would be virtually impossible. President Obama recently upped the ante by urging regulators to impose 1930s-style public utility rules on the net. But the Internet is too important, and innovative, to be treated like the local water company.

SOURCE

********************************

Kill Subsidies to Big Sugar

Taking candy from a baby is easy. Taking sugar from a senator? Not so much. For decades, economists, free market think tanks, good-government advocates, newspaper columnists, and even the occasional elected official have decried the special treatment enjoyed by the American sugar industry.

Under current policies, U.S. sugarcane and sugar beet farmers receive minimum price guarantees regardless of market conditions. In addition, the federal government allots 85 percent of the U.S. sugar market to domestic producers, and it imposes quotas and tariffs on the 40 countries that are allowed to export sugar to America.

In 1993, the Government Accounting Office (GAO) estimated that such policies were costing U.S. consumers $1.4 billion a year because they resulted in "higher prices for domestic sugar." Twenty years later, the University of Michigan–Flint economist Mark J. Perry estimated that this annual cost had grown to $3 billion by 2012, and that consumers and U.S. sugar-using businesses had paid "more than twice the world price of sugar on average since 1982."

In other words, sugar producers are getting a sweet deal, while consumers are getting screwed.

Alas, it's not just the nation's 3,913 sugar beet farms and 666 sugarcane farms that crave the sugar program's artificially sweetened revenues. The program also persists because it offers a steady source of money to elected officials.

In a June 2014 report, Bryan Riley, a senior policy analyst at the Heritage Foundation, noted that while sugar constitutes just 2 percent of the total value of U.S. crop production, the nation's sugar farmers account for 35 percent of the crop industry's total campaign contributions and 40 percent of its lobbying expenditures.

Over the years, major sugar companies such as American Crystal Sugar and Florida Crystals have donated millions of dollars to individual candidates and political action committees. According to OpenSecrets.org, the industry as a whole has donated $41.7 million since 1990. Traditionally it has contributed more to Democrats than Republicans, but in the 2012 election cycle it split its contributions 50/50.

The industry's aggressive lobbying gets results. In 2008, for example, the U.S. sugar trade got somewhat less regulated, when provisions that were drafted as part of the 1994 North American Free Trade Agreement finally kicked in and gave Mexican producers the ability to import unlimited amounts of duty-free sugar to the U.S. In March 2014, however, the U.S. sugar industry accused Mexican producers of dumping their crops on the U.S. market—i.e., selling it for less than the cost of its production, or for less than its domestic price—and asked the U.S. International Trade Commission and the U.S. Department of Commerce to take corrective action.

In October, Commerce announced an agreement between the U.S. and Mexico that will "prevent imports from being concentrated during certain times of the year, limit the amount of refined sugar that may enter the U.S. market, and establish minimum price mechanism to guard against undercutting or suppression of U.S. prices." So don't expect a price cut on Snickers bars any time soon.

Perhaps because the extra $3 billion we spend on sugar each year is amortized over a few hundred billion cans of soda and other sugar-laden treats, consumers don't seem to mind it much.

Greg BeatoAnd yet if we're truly in the midst of a "libertarian moment," when everyday Americans are supposedly fed up with politics as usual and corporate cronyism, how does sugar protectionism remain as American as apple pie? If there ever was a cause that might still inspire comity amongst the highly polarized populous, surely it's sugar.

Indeed, while 11 other countries consume more sugar per capita than the U.S. does, the average American still enjoys around 75 pounds of sugar a year. (This figure doesn't include high fructose corn syrup, zero-calorie artificial sweeteners such as aspartame and sucralose, or zero-calorie naturally derived sweeteners such as stevia.) Our appetite for the stuff cuts across all demographics: Whether you're a progressive elitist snapping up $5 Cronuts in Manhattan or a red-state value shopper buying club packs of Little Debbie Nutty Bars at Costco, you stand to gain from lower sugar prices.

Naturally, sugar farming lobbyists insist this isn't the case. "Sure, cheap subsidized foreign sugar might sound great," exclaims an American Sugar Alliance (ASA) promotional video that alludes to the fact that sugar farmers in Brazil, Mexico, and other countries benefit from their own homegrown subsidy programs. "But depending on others for food never works out as expected."

If we lose our strategic capacity to plant sugar crops, the video suggests, we'll compromise our food security, putting ourselves at the mercy of foreign sugar overlords able to increase prices when global supplies tighten. In October 2013, Tom Giovanetti, president of a Dallas-based research organization called the Institute for Policy Innovation, elaborated on this theme in an essay that argues against unilateral U.S. sugar subsidy disarmament. "Eventually," he concluded, "foreign producers would take advantage of a decimated U.S. domestic sugar industry and would raise prices on U.S. consumers."

But could Brazil—"the OPEC of sugar," according to the ASA—really jack up prices until even those club packs of Little Debbie bars become a rare delicacy only the 1 percent can afford?

"Why on earth wouldn't another producer come and try to take some market share if he sees a monopolist raking in the money?" asks Ike Brannon, formerly chief economist of the House Energy and Commerce Committee and now a fellow at the George W. Bush Institute, in a May 2014 editorial that appeared in USA Today.

Indeed, in a U.S. market free of price supports, allotments, tariffs, and quotas, Brazil wouldn't just be competing with domestic producers for America's business. It'd be competing with the hundred other countries where sugar farming occurs. And as the American Sugar Alliance and various other sugar farming advocates have themselves pointed out, scores of additional countries are just as willing as Brazil or Mexico to subsidize their crops. So if one country even started flirting with the idea of raising prices to non-competitive levels, others would jump at the opportunity to gain a foothold in the large U.S. market by offering more attractive prices.

The truth is that America's food security would in no way be jeopardized by the loss of a domestic sugar industry. Even America's Ding Dongs security would remain intact. "Sugar is a global commodity, with hundreds of thousands of producers all over the world," Perry explains. "This weakens the possibility that one could ever have market power over the U.S. Also there are close substitutes for sugar, like high fructose corn syrup and honey, which further weakens the case that the U.S. could ever be at the mercy of one country, or even a small group of them."

SOURCE

*****************************

For more blog postings from me, see TONGUE-TIED, EDUCATION WATCH INTERNATIONAL, GREENIE WATCH, POLITICAL CORRECTNESS WATCH, AUSTRALIAN POLITICS, and Paralipomena (Occasionally updated) and Coral reef compendium. (Updated as news items come in). GUN WATCH is now mainly put together by Dean Weingarten.

List of backup or "mirror" sites here or here -- for when blogspot is "down" or failing to update. Email me here (Hotmail address). My Home Pages are here (Academic) or here (Pictorial) or here (Personal)

****************************

Sunday, January 11, 2015

More on the decline of Roman civilization

Read here both an essay by Ludwig von Mises and a reply by Sean Gabb. I agree with Gabb.

In my recent essay on the subject I attributed the decline of Roman civilization to Mediterranean piracy that arose in response to the destruction of central authority. Von Mises attributes the decline to price control.

I think Mises has a point and there is of course no doubt that there were several sources of decay. Gabb however sees price control as being at best only a small influence. His reason is that the Roman state was generally ineffective at central control. It could do major and important things like fight wars and suppress pirates (as Caesar did) but detailed social control was beyond it. Price control never really bit, in other words.

Sean Gabb is a libertarian conservative -- as I am -- so is totally opposed to the destructive folly of government price control. But we both prioritze facts over theory.

There is one way in which I don't go quite so far as Sean, however. I doubt that taxes were unimportant. I suspect that they did have substantial destructive impact. But at this point in time, there is no possibility of certainty.

But please read both authors. Both are very scholarly. Mises is of course well known but Gabb is no lightweight. He has even published a book recently that is partly in Latin. I have a copy -- to my considerable delectation. Between them, the two authors do round out our view of one of the most important episodes in human history.

**********************

The Real Islamic Threat

Two weeks after terrorists killed U.S. Ambassador Christopher Stephens and three other Americans in Benghazi in September 2012, Barack Obama announced to the UN, "The future must not belong to those who slander the prophet of Islam."

The Religion of PeaceT took his advice Wednesday in Paris, as jihadis killed 12 people for daring to "slander the prophet of Islam."

Two of the victims were police officers (one of whom was wounded and then executed), and 10 were journalists (including the editor-in-chief) for the French satirical newspaper Charlie Hebdo, which was firebombed in 2011 for printing cartoons of Muhammad. Charlie Hebdo recovered from that terrorism and published a few more cartoons skewering Muhammad and, more recently, the Islamic State. ISIL filled the terror vacuum in the Middle East after Obama claimed victory against al-Qaida ahead of his 2012 re-election bid.

Three masked men perpetrated the well-planned attack with Kalashnikov rifles and other small arms -- perhaps either a rocket or grenade launcher. They reportedly knocked on office doors asking by name for individuals who had created certain offensive cartoons. In a clip aired on French television, the attackers were recorded shouting, "We have killed Charlie Hebdo. We have avenged the Prophet Mohammad."

The men told the journalist they forced to let them in the building that they were from al-Qaida. Meanwhile, ISIL supporters praised the attack.

Not surprisingly, however, White House Press Secretary Josh Earnest initially declined to call it terrorism: "[T]his is an act of violence that we certainly do condemn. And, you know, if based on this investigation it turns out to be an act of terrorism then we would condemn that in the strongest possible terms, too." He also once again referred to Islam as a "Religion of PeaceT."

And the White House issued a statement condemning the attacks while not mentioning the words Islam, Muslim or jihad.

Former DNC Chief Howard Dean flat out denied Islam's culpability: "I stopped calling these people Muslim terrorists. They're about as Muslim as I am. I mean, they have no respect for anybody else's life. That's not what the Koran says. ... I think ISIS is a cult. Not an Islamic cult. I think it's a cult."

Meanwhile, numerous media outlets cowered in fear, refusing to show the Charlie Hebdo cartoons, blurring them out if images were shown at all. By contrast, the Associated Press and other outlets had no problem showing the "piss Christ" "art" some years ago.

Not cowering, however, was cartoonist and Charlie Hebdo editor Stephane Charbonnier, who was killed Wednesday. In 2012, he said, "I prefer to die standing than living on my knees."

The Obama administration clearly would rather kneel, or at least bow. Yes, Secretary of State John Kerry declared the murdered French journalists "martyrs for liberty," and said we "wield something that is far more powerful" than the weapons the jihadis used. But, again, it was his boss who said, "The future must not belong to those who slander the prophet of Islam."

Ironically, in 2012, Obama was condemning an obscure Internet video defaming Muhammad, which his administration blamed ahead of the 2012 presidential election for the al-Qaida attack on Benghazi. Obama's campaign was built on having defeated al-Qaida. And not only did he criticize free speech, U.S. taxpayers footed the bill for ads in Pakistan condemning the video.

Not only will Obama not stand for such "slander," but he has been regularly releasing terrorist leaders from Gitmo, who historically just return to their deadly trade.

While there was much media handwringing about freedom of speech after North Korea compelled Sony to censor a satirical movie, the real threats to free speech are Islamist terrorists. For example, instead of firing off a nasty letter to the editor, the Paris jihadis brutally murdered Charlie Hebdo employees.

Also noteworthy is that the police who initially responded to the attack were, incredibly, unarmed and quickly fled. Indeed, given all the videos that were shot of this attack, it's too bad that Paris is a gun free zone -- instead of shooting videos, someone could have been returning fire.

Furthermore, the French have allowed this Islamist menace to fester in their country for years. In fact, one of the men was a known and convicted terrorist. Now they are paying the price, and make no mistake, this menace is also festering in our homeland. Islamists, like Nidal Malik Hasan, who killed 14 people (including an unborn child) and wounded 30 others at Fort Hood, will continue to strike with increasing frequency. See also the attacks in Boston, Australia and Canada.

While the media refers to these deadly assaults as "lone wolf attacks," there are no such thing. Nor is there a "homegrown" Western threat. All these actors are part of an ideological Islamist web that is not Western. (Anyone for terrorist profiling?)

SOURCE

***************************

Mark Steyn: 'A Lot of People Will Retreat Even Further Into Self-Censorship'

Wednesday's terror attack on Charlie Hebdo in Paris will make major Western newspapers even more fearful to say anything about Islam, conservative pundit Mark Steyn warned on Wednesday.

"I think one consequence of this is that a lot of people will retreat even further into self-censorship," Steyn told Fox News's Megyn Kelly.

In fact, several major newspapers on Wednesday, in reporting on the Paris attack, obscured the cartoon images of Mohammed published by Charlie Hebdo.

"The New York Daily News won't even show -- and it dishonors the dead in Paris by not even showing properly the cartoons. They pixilated Mohammed out of it, so it looks like Mohammed is into the witness protection program, but they left the hook-nose Jew in, and that exactly gets to the double standard here.

"You can say anything you like about Christianity, you can say anything you like about Judaism, but these guys -- everybody understand the message that if you say something about Islam, these guys will kill you.

"And we will be retreating into a lot more self-censorship if the pansified Western media doesn't man up and decide to disperse the risk. So they can't just kill one little small French satirical magazine, they've got to kill all of us."

Steyn noted that Charlie Hebdo was one of the few publications willing to reprint the Danish Mohammed cartoons in 2006: "I'm proud to have written for the only Canadian magazine to publish those cartoons," Steyn added.

"And it's because The New York Times didn't, and Le Monde in Paris didn't and the London Times didn't, and all the other great newspapers of the world didn't, that they (Charlie Hebdo) were forced to bear a burden that should have been more widely dispersed."

The cartoons have become a news story, especially after people have been killed for them, Steyn said: "But the fact that major newspapers still didn't have the courage to show these cartoons after they became a news story, is why these brave men at Charlie Hebdo had to bear the burden almost single-handed."

SOURCE

******************************

7 Offensive Images The New York Times Wasn't Afraid to Publish

Dean Baquet, the executive editor of The New York Times, is defending his decision not to reprint any Charlie Hebdo cartoons depicting Mohammad with an argument that might confuse Times readers. Today he told Politico: "We don't run things that are designed to gratuitously offend."

This dictum is confusing because it's false: On many occasions the paper of record has printed images that are "designed to gratuitously offend." Here are 7 examples; there are surely more.

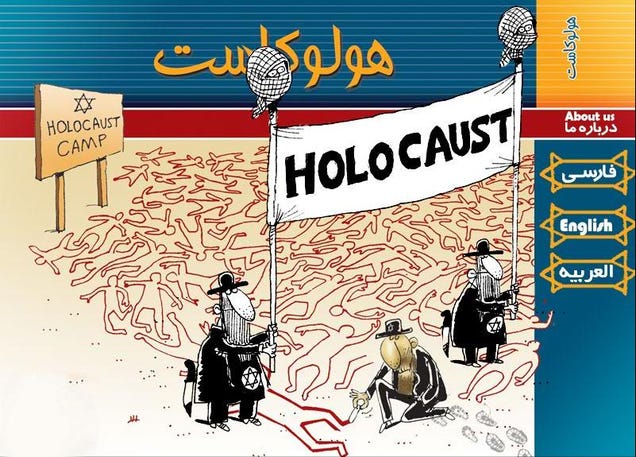

1. The Times printed this anti-Semitic cartoon in 2010:

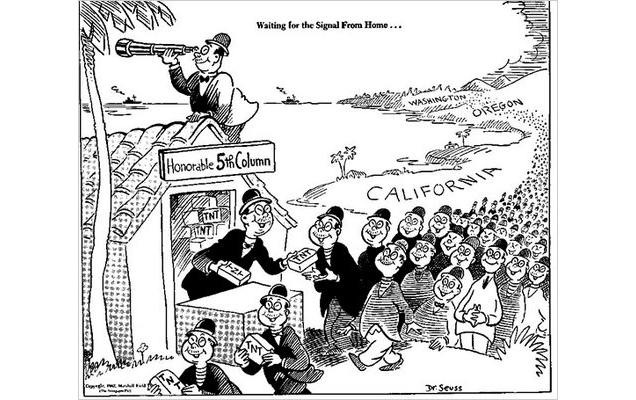

2. This racist Dr. Seuss drawing in 2011:

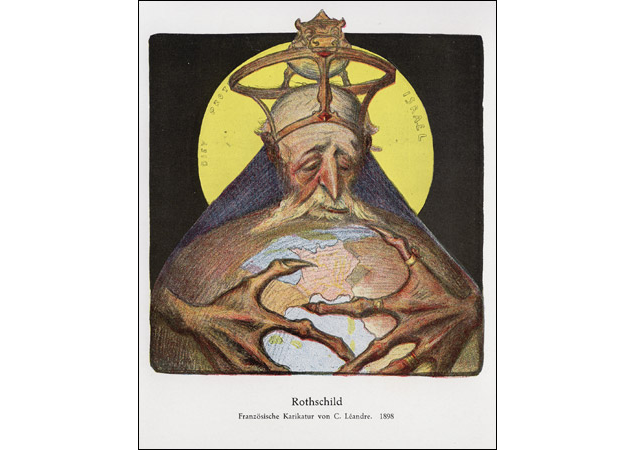

3. This anti-Semitic caricature in 2005:

More HERE

****************************

California Just Started Another Insane Government Project

Talk about a trainwreck. Today, California broke ground on another disastrous government-funded project: high-speed rail that will eventually go from San Francisco to Los Angeles.

The project is estimated to cost $68 billion. The plan is that the private sector will ultimately invest around one-third of the total cost, but so far, there have been no takers. And it's no wonder. It's hard to see how this project makes sense.

Backers say the train will be able to make the trip between San Francisco and Los Angeles in under 2 hours, 40 minutes. However, according to a 2013 Reason Foundation study, it's likely the trip will ultimately take around four hours (and sometimes closer to five hours) for various reasons (for example, the high-speed train will share tracks with slower trains).

To put that into context, consider this: A flight from San Francisco to Los Angeles is about 1 hour, 15 minutes. Driving, if there isn't traffic, takes a little under six hours-more time than the train would take, but you also have a vehicle at the end of your trip. (Neither San Francisco nor Los Angeles are cities easy or convenient to navigate via public transit, although San Francisco certainly has more options than Los Angeles.)

So in other words, it's a $68 billion project to build a method of transit that combines the longer time of driving with the lack of convenience of flying (that is, arriving without a car).

And this is all assuming the full project is completed. Currently, the state has only $12.6 billion-from federal funding and a voter-approved bond measure-ready for the project.

The first steps will lead to tracks connecting Fresno and Bakersfield-two cities that have no public transportation other than buses. It's hard to see why a big market of people would be looking to take the high-speed train between these two places, which are already connected by highways and train.

Furthermore, it's possible that the high-speed rail train, rather than making a profit or breaking even, will lose even more money when operating. Remember, that $68 billion is just to build it.

From the 2013 Reason Foundation study:

Even if the system managed to equal European train ridership levels it would hit just 7.6 million rides a year. Thus, ridership in 2035 is likely to be 65 percent to 77 percent lower than currently projected.

As a result of these slower travel times, higher ticket costs and low ridership, California taxpayers should expect to pay an additional $124 million to $373 million a year to cover the train's operating costs and financial losses.

Heritage Foundation transportation analyst Emily Goff offers yet another possible snag: "It's typical for big-ticket infrastructure projects like this train to experience cost escalations-of gargantuan proportions. Cue Northern Virginia's defunct Arlington Streetcar and Washington Metro's Silver Line. We'll see any increases in the $68 billion cost reflected in more severe operating losses down the line."

California's struggling enough as is. Building a costly high-speed rail train with few obvious consumers is a mistake-and one that will likely cost taxpayers dearly.

SOURCE

*****************************

For more blog postings from me, see TONGUE-TIED, EDUCATION WATCH INTERNATIONAL, GREENIE WATCH, POLITICAL CORRECTNESS WATCH, AUSTRALIAN POLITICS, and Paralipomena (Occasionally updated) and Coral reef compendium. (Updated as news items come in). GUN WATCH is now mainly put together by Dean Weingarten.

List of backup or "mirror" sites here or here -- for when blogspot is "down" or failing to update. Email me here (Hotmail address). My Home Pages are here (Academic) or here (Pictorial) or here (Personal)

****************************

Friday, January 09, 2015

Another nail in coffin of the antioxidant religion

Are antioxidants a waste of money? Latest study says eating expensive 'superfoods' or taking supplements WON'T help you live longer. That dynamo of research in the area, Beatrice Golomb, will not be surprised. In a recent correspondence with me she said: "Personally, I have never advocated, to anyone, carotenoids, vitamin C, vitamin E as d-alpha tocopherol, or folic acid in supplement form". The only pill that she is favors these days is the recently revived CoEnzyme Q10 -- but see here, here and here for skepticism about that

People who get a lot of antioxidants in their diets, or who take them in supplement form, don't live any longer than those who just eat well overall, according to a long term study of retirees in California.

Antioxidants, including vitamins A, C and E, are plentiful in vegetables and fruits and may help protect against cell or DNA damage. As a result, they've been touted for cancer prevention, heart disease prevention and even warding off dementia.

'There is good scientific evidence that eating a diet with lots of vegetables and fruits is healthful and lowers risks of certain diseases,' said lead author Annlia Paganini-Hill of the Clinic for Aging Research and Education at the University of California, Irvine.

'However, it is unclear whether this is because of the antioxidants, something else in these foods, other foods in people's diet, or other lifestyle choices,' Paganini-Hill told Reuters Health by email.

Most double-blind randomized clinical trials - the gold standard of medical evidence - have found that antioxidant supplements do not prevent disease, she said.

The researchers used mailed surveys from the 1980's in which almost 14,000 older residents of the Leisure World Laguna Hills retirement community detailed their intake of 56 foods or food groups rich in vitamins A and C as well as their vitamin supplement intake.

With periodic check-ins and repeated surveys, the researchers followed the group for the next 32 years, during which time 13,104 residents died.

When Paganini-Hill's team accounted for smoking, alcohol intake, caffeine consumption, exercise, body mass index, and histories of hypertension, angina, heart attack, stroke, diabetes, rheumatoid arthritis and cancer, there was no association between the amount of vitamins A or C in the diet or vitamin E supplements and the risk of death.

Participants in the new study were largely white, educated and well-nourished.

SOURCE

******************************

The TSA: A Brief Tale

By Abigail Hall

This Christmas I flew out of town with my fiancé to see his family. Since we’d be out of town for several days, I checked a bag with the airline.

We arrived to our destination without any fuss and drove to see his family. As I went to my bag to retrieve some things before bed, I was greeted by a note from the TSA. The paper stated that my bag had been searched as a part of necessary “security” precautions.

Aside from looking like a five-year-old had packed my bag, everything seemed fine (I’m a careful packer—so the fact my folded clothes were left in wads was particularly irritating). Upon further inspection, however, I realized some things were missing from my luggage.

Those things were my underwear.

Now, in the “best” case scenario, either these items were taken out of my bag and accidentally put in someone else’s (that’s awkward) or the person who searched my bag decided fruit of the loom posed a security risk (I always thought those characters from the commercial looked shady). Worst case scenario, some TSA agent stole my underwear.

Apparently, I’m not the only one who has wound up with some missing items at the hands of the TSA. In fact, some 29 TSA employees were fired for theft from Miami’s airport between 2002 and 2011. Over the same period, 27 agents were fired from JFK International. In total, a report on TSA theft obtained through the Freedom of Information Act found that the TSA fired over 400 employees for theft between 2002 and 2011.

The agents tasked with “keeping travelers safe” have gotten their hands on more than passengers’ small trinkets. Former TSA officer Pythias Brown, for example, was convicted of stealing some very expensive items from passengers. He admitted to taking some $800,000 worth of cameras and other items from checked bags.

When discussing his crime, Brown said the TSA had “a culture” of theft. He stated it was easy for TSA employees to take advantage of passengers’ luggage because of lax oversight and tips from their fellow employees. “[Stealing from checked bags] became so easy, I got complacent,” Brown said in an interview.

Brown certainly isn’t the only one. One officer was arrested for stealing some $5,000 in cash from a passenger’s jacket while another made off with a $15,000 watch. While the TSA is quick to point out that the number of thefts by TSA agents represents only a small proportion of their employees (which is true), it may be more commonplace than admitted. After all, it’s not exactly difficult to blame lost items on the general gross incompetence of airlines. The agency also states they have a “zero tolerance” policy for theft.

In spite of this zero tolerance policy, TSA agents have been arrested and convicted for stealing items including iPads, laptops, and a $40,000 piece of luggage.

The problem of theft seems simple enough to address. For example, how about that card put in my suitcase informing me of the “necessary procedure?” One could easily assign a number to each agent and print this number on the tickets placed in passenger suitcases. This would allow complaints to be easily traced to specific agents.

I’ve written elsewhere about problems with the TSA. Not only does the TSA violate your individual liberties every time you fly, it has also failed to catch a single terrorist since it was formed in 2001.

Put simply, the TSA faces poor incentives. The bureaucratic structure of the agency, without having to contend with the profit and loss mechanisms of for profit firms, means the agency must constantly appeal to the government for support.

As opposed to increasing revenues through improving its product and customer service, the TSA obtains more money and personnel by being worse at its job. Why? Poor performance, theft, and other problems means the TSA can say to the larger government, “we perform poorly because we need more resources. We have theft problems, we need more people to supervise, more training, and more resources.”

The result of these incentives is an ever-growing, dysfunctional organization. This agency not only fails to “keep you safe,” but might just steal your underwear.

SOURCE

*****************************

The Next Detroit

What’s wrong with giving government employees every single dollar they ask for in pensions and benefits?

After having seen the role of out-of-control public employee pensions in helping drive the city of Detroit into bankruptcy, which the city was only just able to exit in November 2014 after the city’s public pensioners finally agreed to cut their overly generous pensions and benefits to levels that are more affordable for the city’s taxpayers, we wondered which local government in the U.S. is most like Detroit in the disconnect it has between the size of its debts and its ability to make good on those liabilities.

We didn’t have to spend much time researching the topic. America’s next Detroit is Illinois. At least, according to The Economist, which being international in scope, directly compares the fiscal state of Illinois with its most similarly dysfunctional European equivalent: Greece....

Illinois is like Greece in one obvious way: it overpromised and underdelivered on pensions and has little appetite for dealing with the problem, says Hal Weitzman of the University of Chicago Booth School of Business. This large Midwestern state, with a population of 13m (Greece has 11m, though a far smaller GDP than Illinois), has the most underfunded retirement system of any state and the largest pension burden relative to state revenue. It also has the highest number of public-pension funds close to insolvency, such as the one looking after Chicago’s police and firemen. According to the Civic Federation, a budget watchdog, Illinois has piled up a whopping $111 billion in unfunded pension liabilities (see chart), in addition to $56 billion in debt for health benefits for pensioners. The state devotes one in four of its tax dollars to pensions, which is more than it spends on primary and secondary education.

Mainly as a result of this gargantuan pension debt, Illinois’s bond rating is the lowest of all the states, which means dramatically higher borrowing costs. When the state government failed to address pension underfunding in its budget for 2014, two credit-rating agencies, Fitch and Moody’s, cut the state’s bond rating, which in Moody’s case put Illinois on a par with Botswana. (An incensed editorial in the Chicago Tribune asked what Botswana had done to be so insulted.)

The main reason for the pension debacle is decades of underfunding. “Everything was always done with a short-term view,” says Laurence Msall, head of the Civic Federation. “Unique to Illinois is the idea that you don’t have to pay for pensions and you don’t have to follow actuarial recommendations.”

Unlike Detroit, however, Illinois has an extra barrier that is preventing desperately needed reforms for making its public employee pensions sustainable by reducing promised pension payments and benefits to affordable levels: the State of Illinois’ Constitution.

Here, the state’s top law prevents lawmakers from even being able to address its worsening public employee pension crisis by diminishing or impairing pension benefits to retired government employees at all. The state’s only way out is a “long shot” attempt to amend its Constitution, but that would require that the people responsible for creating the crisis in the first place, public employee unions and the large number of officials they helped put into power, go against their own greedy interests in favor of the public’s best interest.

Unfortunately, with such a stacked deck, it’s in their greedy interest to push Illinois to the very edge of insolvency. And all indications are that they will fight reform rather than give up their guaranteed gravy train.

That’s the sort of thing that doesn’t even fly in communist China, which has implemented real public employee pension reforms to meet the public’s interest! If only Illinois’ elected officials would show similar public spirit.

SOURCE

**************************

Jonathan Gruber: No Obamacare Subsidies in States That Don't Set Up Exchanges

In this new year, the U.S. Supreme Court will hear another challenge to the Affordable Care Act. And this time, Obamacare architect Jonathan Gruber's own words may help the people who are challenging a key provision of the law.

In petitioning the Supreme Court to take their case, the plaintiffs quoted Gruber, who said in 2012: "[I]f you're a state and you don’t set up an Exchange, that means your citizens don’t get their tax credits. … I hope that’s a blatant enough political reality that states will get their act together and realize there are billions of dollars at stake here in setting up these Exchanges, and that they’ll do it.”

The problem arose when only 14 states took federal money to set up their own exchanges.

So the question before the Supreme Court is this: How can people in states with federally-run exchanges get tax-credit subsidies? The law says they can't; but the IRS, by regulation, said they can.

In their request for Supreme Court review, the petitioners noted that the Affordable Care Act authorizes federal tax credit subsidies for health insurance coverage that is purchased through an “Exchange established by the State."

“Congress did not expect the states to turn down federal funds and fail to create and run their own Exchanges,” the petition says. "Accordingly, for example, Congress did not appropriate any funds in the ACA for HHS to build Exchanges, even as it appropriated unlimited funds to help states establish theirs...Indeed, ACA proponents emphasized that '[a]ll the health insurance exchanges … are run by states,' to rebut charges that the Act was a federal 'takeover.'"

The petition continues: "Notwithstanding the ACA’s text and purpose, the IRS in 2011 proposed, and in 2012 promulgated, regulations requiring the Treasury to grant subsidies for coverage purchases through all Exchanges -- not only those established by states...but also those established by HHS."

Gruber's own words, therefore, appear to be central to the petitioners' case.

Repeating what he said in 2012: "[I]f you're a state and you don’t set up an Exchange, that means your citizens don’t get their tax credits. … I hope that’s a blatant enough political reality that states will get their act together and realize there are billions of dollars at stake here in setting up these Exchanges, and that they’ll do it.”

Under Obamacare, subsidies (or tax credits) are an essential part of "affordable" health insurance coverage. Without them, most people wouldn't be able to afford the health insurance they are now required by law to purchase (or else pay a fine).

On Dec. 30, the Department of Health and Human Services reported that 87 percent of people who selected 2015 plans through the federal exchange HealthCare.gov in first month of open enrollment were getting subsidies to lower their monthly premiums. That compares with the 80 percent of enrollees who purchased plans on the federal exchange in the same period last year.

According to SCOTUSblog, oral arguments in the case King V. Burwell are scheduled for Mar 4, 2015.

SOURCE

****************************

For more blog postings from me, see TONGUE-TIED, EDUCATION WATCH INTERNATIONAL, GREENIE WATCH, POLITICAL CORRECTNESS WATCH, AUSTRALIAN POLITICS, and Paralipomena (Occasionally updated) and Coral reef compendium. (Updated as news items come in). GUN WATCH is now mainly put together by Dean Weingarten.

List of backup or "mirror" sites here or here -- for when blogspot is "down" or failing to update. Email me here (Hotmail address). My Home Pages are here (Academic) or here (Pictorial) or here (Personal)

****************************

Thursday, January 08, 2015

Islam's great gap -- 650 to 800 AD -- and the destruction of Roman civilization. Was North African piracy the revenge of Carthage?

Thanks to Byzantium we have some idea of what happened in Europe during the "dark" ages. It is a common misconception that the sacking of Rome by barbarian tribes ended the Roman empire. It did not. Roman civilization had become decentralized by then -- which is part of the reason why Rome was too weak to defend itself effectively. So the other great cities of the Roman world continued on much as before, as most of them had already made their peace with the German barbarians. And the German barbarians in turn had by that time also absorbed a fair amount of civilization. So the sack of Rome was in some ways just an internal re-organization.

So Roman civilization did decline but it did not suddenly cease. And after a couple of centuries the decline was extensive and the times did really become dark ages in many ways.

So if the sack of Rome did not end Roman civilization, what did? Mediterranean piracy. The Roman empire was a huge free trade area and trade has always been the secret of economic prosperity. It's why we have things as NAFTA and the EU. Free trade brings specialization in what people and places are good at. In the Roman empire, for instance, much of Rome's grain was imported from Egypt.

And trade was far too advantageous for something like the fall of Rome to interrupt it. It carried on as before. But the loss of Roman authority did have one clear penalty. North African statelets evolved under no form of Roman control and acknowledging no debt to Rome. For a time Byzantium had control of North East Africa but North Western Africa (what we now call Algeria, Morocco etc) was a stretch too far. And it was from North West African statelets that a substantial pirate menace emerged. Piracy was a major economic support for the "Barbary" states. And that piracy continued in fits and starts for a long time -- until the restored French monarchy sent 500 ships across the water and brought North West Africa under French control in 1830.

And for a time the piracy killed the goose that laid the golden egg. So much of money and goods was lost to the pirates that trade became unprofitable and effectively impossible. And the cessation of trade pulled the rug out from under Roman prosperity. All the old Roman lands and cities went into a steep economic decline. Even Byzantium was affected to a degree though its large areas of control in the Eastern Mediterranean shielded it from the worst effects. A lot of its trade was internal and carried overland.

So who were these pirates? Most memory of them traces to the 19th century and identifies them as Muslim Arabs and Muslim Berbers. Both the administrations of Thomas Jefferson and James Madison in the newborn United States took them on. But were they Muslim in the Middle ages? Probably not -- for two reasons: Mohammed supposedly appeared in the 7th century and the Roman world was already in decline by then. More importantly, however, it seems likely that the whole Mohammed story is fiction and that the Koran was written in Egypt some time in the 9th century. See also here

Shock! Horror! Scholars who are bold enough to mention that probability do so at considerable risk and I guess I do too. But the matter is surely too important to be hushed up. The fact of the matter is that the story of Mohammed is much more poorly documented than the story of Christ. Not only do Christians have four separate histories of Christ's life (the Gospels) but there is also an extensive collection of letters from Paul and others -- all of which are collected into the New Testament. There is nothing like that for Mohammed. There is only the Koran, nothing else. There are hadiths but they are clearly later. And aside from the Koran there is no mention in history of Mohammed and his followers until about 800 AD. So was it in the 9th century that the Koran was written?

It seems likely. Egypt was at that time mostly Christian. But it was Christianity with Egyptian characteristics, to coin a phrase. In particular it was a hotbed of Gnosticism -- which was apparently much influenced by the old pagan Egyptian religion of the Pharaohs. And the Gnostics were prolific producers of false Gospels, accounts that claimed to tell of Christ's life and words but which were nothing but forgeries written to boost up a particular theological position or Gnostic belief. So in that hotbed of debate, the production of another forgery, the Koran, was nothing new. It would seem that someone thought to get one-up on his theological opponents by inventing a new account of holy deeds.

Raiders from the Arabian peninsula were certainly making a nuisance of themselves in the 7th and 8th centuries but there is no evidence that they were Muslims. They were generally called "Saracens" at the time.

And backing up the idea of the Koran as just another Gnostic forgery, is the fact that the Koran is very Bible-conscious. It borrows heavily from both the Old and New testaments and accepts much of what Christians say about Christ.

And by the 9th century, the old Roman word was comprehensively gone. So the North African pirates who destroyed that world cannot have been Muslim. They accepted Islam later on.

So if the early pirates were not Muslim, who were they? We know that lots of marauding German tribes did get to North Africa and settle there so it is likely that the pirate states originated as just another band or bands of German raiders -- but raiders with a nautical bent. And if they were of a nautical bent they probably came from the Baltic area. And we do know of another group of German raiders of around 500 AD who sailed from the Baltic area -- the Angles and the Saxons who invaded Roman Britannia and turned it into England. So seaborne Germans of the time are no myth.

But the raiding went on for a long time so the pirates would soon be comprised of some admixture of the Germans with the native people of the area. The geneticists tell us that the modern-day English are only around 50% German so that percentage may have been even less in North Africa, being further way from the German homeland. It is notable, moreover that some Berbers to this day have light skin and blue eyes.

And the native people would have been substantially descended from Rome's old adversary, Carthage. Carthaginians were originally Phoenicians but eventually included a large admixture of the native North African Berber people. Carthaginian general Hannibal had given the Romans huge problems -- the destruction of eight Roman legions at Cannae resounds to this day -- so when Publius Cornelius Scipio finally defeated Hannibal's Carthaginian army, the game was up for Carthage. And after further hostilities, Rome laid waste to the city and allegedly salted its fields. That something as valuable as salt then was, was wasted in that way makes it unlikely that much salt was used, however. But the Carthaginians were more than one city and we know that Carthage had substantially revived only a couple of centuries later -- but revived under firm Roman control of course.

So there is a certain irony in the destruction of the Roman world by probable descendants of the great city that Rome had tried to destroy.

****************************

How the Laffer Curve Changed America's Economy

It was 40 years ago this month that two of President Gerald Ford’s top White House advisers, Dick Cheney and Don Rumsfeld, gathered for a steak dinner at the Two Continents restaurant in Washington with Wall Street Journal editorial writer Jude Wanniski and Arthur Laffer, former chief economist at the Office of Management and Budget. The United States was in the grip of a gut-wrenching recession, and Laffer lectured to his dinner companions that the federal government’s 70 percent marginal tax rates were an economic toll booth slowing growth to a crawl.

To punctuate his point, he grabbed a pen and a cloth cocktail napkin and drew a chart showing that when tax rates get too high, they penalize work and investment and can actually lead to revenue losses for the government. Four years later, that napkin became immortalized as “the Laffer Curve” in an article Wanniski wrote for the Public Interest magazine. (Wanniski would later grouse only half-jokingly that he should have called it the Wanniski Curve.)

This was the first real post-World War II intellectual challenge to the reigning orthodoxy of Keynesian economics, which preached that when the economy is growing too slowly, the government should stimulate demand for products with surges in spending. The Laffer model countered that the primary problem is rarely demand – after all, poor nations have plenty of demand – but rather the impediments, in the form of heavy taxes and regulatory burdens, to producing goods and services.

In the four decades since, the Laffer Curve and its supply-side message have taken something of a beating. They’ve been ridiculed as “trickle down” and “voodoo economics” (a phrase coined in 1980 by George H.W. Bush), and disparaged in mainstream economics texts as theories of “charlatans and cranks.” Last year, even Pope Francis criticized supply-side theories, writing that they have “never been confirmed by the facts” and rely on “a crude and naive trust in the goodness of those wielding economic power and in the sacralized workings of the prevailing economic system.” And this year, French economist Thomas Piketty penned a best-selling back-to-the-future book arguing for a return to the good old days of 70 percent tax rates on the rich.

But I’d argue – and not just because Laffer has been a longtime friend and mentor – that his theory has actually held up pretty well these past 40 years. Perhaps its critics should be called Laffer Curve deniers.

Solid supporting evidence came during the Reagan years. President Ronald Reagan adopted the Laffer Curve message, telling Americans that when 70 to 80 cents of an extra dollar earned goes to the government, it’s understandable that people wonder: Why keep working? He recalled that as an actor in Hollywood, he would stop making movies in a given year once he hit Uncle Sam’s confiscatory tax rates.

When Reagan left the White House in 1989, the highest tax rate had been slashed from 70 percent in 1981 to 28 percent. (Even liberal senators such as Ted Kennedy and Howard Metzenbaum voted for those low rates.) And contrary to the claims of voodoo, the government’s budget numbers show that tax receipts expanded from $517 billion in 1980 to $909 billion in 1988 – close to a 75 percent change (25 percent after inflation). Economist Larry Lindsey has documented from IRS data that tax collections from the rich surged much faster than that.

Reagan’s tax policy, and the slaying of double-digit inflation rates, helped launch one of the longest and strongest periods of prosperity in American history. Between 1982 and 2000, the Dow Jones industrial average would surge to 11,000 from less than 800; the nation’s net worth would quadruple, to $44 trillion from $11 trillion; and the United States would produce nearly 40 million new jobs.

Critics such as economist Paul Krugman object that rapid growth during the Reagan years was driven more by conventional Keynesian deficit spending than by reductions in tax rates. Except that 30 years later, President Obama would run deficits as a share of GDP twice as large as Reagan’s through traditional Keynesian spending programs, and the economy grew under Obama’s recovery only half as fast.

Supply-side economics was never just about slashing tax rates. As Laffer told me in a recent interview: “We also emphasized sound money, free trade and deregulation. It was a package of reforms to clear away the obstacles to increased economic output.”

I asked Laffer about the economy’s surge, while income tax rates rose, during the Clinton presidency – which critics cite as repudiation of supply-side theories. Laffer noted that tax rates on work and investment fell in the ‘90s. “Under Clinton we had the biggest reduction in government spending in 30 years, one of the steepest reductions in the capital gains tax, a big cut in the tax on traded goods thanks to NAFTA, and welfare reforms which dramatically increased incentives to work. Of course the economy soared.”

As to the concern that supply-side tax-cutting has exacerbated income inequality: The real story of the 1980s and '90s was one of upward economic mobility. After-tax incomes of middle-class families rose by roughly 30 percent (when taking into account government benefits and correctly adjusting for inflation) from 1982 to 2005. The middle class didn’t shrink, it grew richer – though the past decade has seen a big reversal.

Perhaps the most powerful vindication of the Laffer Curve comes from the many nations around the world that have successfully integrated supply-side economics into their fiscal policies. World Bank statistics reveal that almost every nation – from China to Ireland to Chile – has much lower tax rates today than in the 1970s. The average income tax rate among industrialized nations has fallen from 68 percent to less than 45 percent. The average corporate tax rate has fallen from nearly 50 percent to closer to 25 percent today. Political leaders learned from Reagan that in a globally competitive world, jobs, capital and wealth tend to migrate from high- to low-tax locations.

This vital link between low taxes and jobs has played out within the United States as well. It helps explain why, from 2002 to 2012, Texas – with no income tax – gained 1 million people in domestic migration, while almost 1.5 million more Americans left California, with its 12 percent top tax rate, than moved there.

It’s worth noting that there has been some shift in emphasis among advocates of supply-side economics. The original Laffer Curve illustrated that two tax rates lead to zero revenue: a rate of zero and a rate of 100 percent – because no one will work if all earnings are taken away. Yes, in some cases tax rates can get so high that cutting them will raise more revenue, not less. That was clearly true when capital-gains tax rates were slashed in the 1980s and 1990s, and when in 2004 the federal government enacted a repatriation tax cut on foreign earnings held captive overseas. Revenue rose in all of these instances. But today, even the most ardent disciples of the Laffer Curve don’t argue that cutting tax rates will increase revenue – except in extreme cases when rates are at the very highest range of the curve.

We do argue, and history is our guide, that lower tax rates are a private-sector stimulus that in many circumstances will rev up growth and lead to more jobs. It’s a happy byproduct that this growth will help generate higher revenue than the government’s “static” estimates always undercount.

Alas, the Laffer Curve effect is now working against the United States on corporate taxation. Our highest-in-the-world corporate tax rate of nearly 40 percent is chasing iconic U.S. companies such as Burger King and dozens of others out of the country for lower-tax climates where rates are half as high.

Even liberals unwittingly acknowledge the Laffer Curve truth when they support higher tobacco taxes to stop smoking or a new carbon tax to reduce global warming. If higher carbon taxes reduce CO2 emissions, why is it so hard to understand that higher taxes on work or investment lead to less of these?

When I asked Laffer if, 40 years later, there is any point of consensus in economics on the Laffer Curve, he replied: “I think today everyone agrees with the premise that when you tax something you get less of it, and when you tax something less, you get more of it.”

SOURCE

***********************

Harvard Profs Angry ObamaCare Made Their Premiums Rise

Liberal academics at Harvard are as incensed as anybody else that their health care costs for 2015 have headed for the ceiling because of the “Affordable” Care Act. Harvard professor Richard Thomas said the changes were “deplorable, deeply regressive, a sign of the corporatization of the university.” But – get this – these same professors advised the Obama administration as it crafted this policy.

The New York Times reports, “In Harvard’s health care enrollment guide for 2015, the university said it ‘must respond to the national trend of rising health care costs, including some driven by health care reform,’ in the form of the Affordable Care Act.

The guide said that Harvard faced ‘added costs’ because of provisions in the health care law that extend coverage for children up to age 26, offer free preventive services like mammograms and colonoscopies and, starting in 2018, add a tax on high-cost insurance, known as the Cadillac tax.”

National Review’s Patrick Brennan notes the Leftmedia can’t quite explain away this argument for free market health care. Maybe Harvard professors should advise the White House in a new health care policy given their new real-world experience.

SOURCE

****************************

For more blog postings from me, see TONGUE-TIED, EDUCATION WATCH INTERNATIONAL, GREENIE WATCH, POLITICAL CORRECTNESS WATCH, AUSTRALIAN POLITICS, and Paralipomena (Occasionally updated) and Coral reef compendium. (Updated as news items come in). GUN WATCH is now mainly put together by Dean Weingarten.

List of backup or "mirror" sites here or here -- for when blogspot is "down" or failing to update. Email me here (Hotmail address). My Home Pages are here (Academic) or here (Pictorial) or here (Personal)

****************************

Wednesday, January 07, 2015

Once again we find that the Bible is good history

Have archaeologists discovered where Jesus was sentenced to death? Site at Herod's Palace 'matches Gospel of John description'

The exact spot upon which Jesus stood as he was sentenced to death, may have been pinpointed by archaeologists in Jerusalem.

Discovered around 15 years ago, the remains of Herod the Great’s palace have been carefully examined and a place between a gate and uneven stone pavement has been identified as fitting the description of the event in the Gospel of John.

Pilgrims and tourists will be able to visit the Biblical site, because tours are being offered by the Tower of David Museum, which is located nearby.

Archaeologists suspected the site’s religious and historical significance when they uncovered parts of foundation walls of the palace and an underground sewage system, when excavating an abandoned prison, The Washington Post reported.

While historians largely agree that Herod’s palace stood in the west of Jerusalem’s Old City, whether Jesus was sentenced to death by Pontius Pilate inside it, is the subject of much debate. This is mainly due to differing interpretations of the Gospels.

The Gospel of John describes the trial of Jesus taking place near a gate and uneven pavement, which some archaeologists, including Shimon Gibson, an archaeology professor at the University of North Carolina at Charlotte, believe matches evidence at the site.

‘There is, of course, no inscription stating it happened here, but everything - archaeological, historical and gospel accounts - all falls into place and makes sense,’ he said.

The Reverend David Pileggi, minister of Christ Church located nearby the museum, told the newspaper that the discovery confirms ‘what everyone expected all along, that the trial took place near the Tower of David.’

SOURCE

******************************

Thank Gridlock for Economic Turnaround

The Obama Boom is finally here. Gross domestic product grew by a healthy 5 percent in the third quarter, the strongest growth we’ve seen since 2003. Consumer spending looks as if it’s going to be strong in 2015. Unemployment numbers have looked good. Buying power is up. And the stock market closed at 18,000 for the first time ever. All good things. So what happened?

Here’s David Axelrod on Twitter: “Note: The quarter before Obama took office, the U.S. economy SHRUNK by 8.9 percent, worst since 1930. Last quarter it GREW by 5 percent, best since 2003.”

Note: Contrasting the most severe quarter of your predecessor’s with the best one in your six-year presidency – one filled with extravagant and unmet economic promises – may strike you as a bit hackish. But let’s go with it.

Axelrod isn’t alone is claiming political credit for economic success, and the Obama administration certainly isn’t the first to try to take the glory. But if activist policies really have as big an impact on our economic fortunes as Washington operatives claim, I only have one question: What policy did Barack Obama enact to initiate this astonishing turnaround? We should definitely replicate it.

Because those who’ve been paying attention these past few years may have noticed that the predominant agenda of Washington has been to do nothing. It was only when the tinkering and superfluous stimulus spending wound down that fortunes began to turn around. So it’s perplexing how the same pundits who cautioned us about gridlock’s traumatizing effects now ignore its existence.

For instance, Paul Krugman wrote a column titled “The Obama Recovery.” The problem is that the author failed to justify his headline. It begins like this:

“Suppose that for some reason you decided to start hitting yourself in the head, repeatedly, with a baseball bat. You’d feel pretty bad. Correspondingly, you’d probably feel a lot better if and when you finally stopped. What would that improvement in your condition tell you?”

Suppose you tell us what the bat represents, because spending in current dollars has remained steady since 2010, and spending as a percentage of GDP has gone down. In 2009, 125 bills were enacted into law. In 2010, 258. After that, Congress, year by year, became one of the least productive in history. And the more unproductive Washington became the more the economy began to improve.

Krugman argues that the recession lingered because government hadn’t hired enough people to do taxpayer-funded busywork. The baseball bat. But then he undercuts this notion by pointing out that there was an explosion of public-sector hiring under George W. Bush – the man he claims caused the entire mess in the first place. Krugman also ignores the stimulus, because it screws up his imaginary “austerity” timeline. He then spends most of the column debunking austerity’s success in Britain.

He does this because, in theory, left-wing economic policies can never lose. For years, the administration rationalized the crippling unemployment we experienced by spinning a comforting counter-history: Things would have been a lot worse. But didn’t the stimulus fail even if we judged it on its own promises? Well, it should have been bigger. Wasn’t this the slowest recovery in history? Well, this was the worst situation since the Great Depression.

The Boston Globe, in an editorial reflecting much of the evidence-free praise the president has gotten, spins another myth. It points to policies passed in 2010 as the reason for growth today. But it’s just as easy – and more plausible, when we consider the history of our strong emergence from severe recessions – to suggest that the economy could have been a lot better had the administration alleviated many of its early regulatory and tax burdens. Or done nothing. Certainly, a person could just as effortlessly argue that shoehorning huge agenda items under the guise of spurring growth was more harmful than helpful.

“People often don’t realize that a political system is sometimes effective when it does not do certain things.” Pietro Nivola, a senior fellow in governance studies at The Brookings Institution, argued in 2012. “You can’t just measure the things it does, the actions it takes; you also have to measure the actions it does not take.” Nivola was impressed by how gridlock has the ability to stop the Republican House from cutting spending too abruptly for the economy.

And perhaps he’s right. Gridlock has caused an odd but pervasive stability in Washington. Spending has been static. No jarring reforms have passed – no cap and trade, which would have artificially spiked energy prices and undercut the growth we’re now experiencing. The inadvertent but reigning policy over the past four years has been “do no harm.”

On the strength of good economic news, Politico reports that Obama will use his State of the Union address to roll out an agenda aimed at the stagnating wages and those Americans left behind to build on the growth. I’m going to take a wild guess and say that it’s going to incorporate a lot of happy talk about “infrastructure” and a fairer reallocation of wealth. We need to grow from the middle out, if you will. No doubt, politically speaking, Democrats' fortunes are bound to improve somewhat as economic anxieties ebb. The president will surely see better approval numbers.

But let’s hear specifics. As I remember it, the administration hasn’t done anything in a long time. I know this because an incalculable number of op-eds have informed me that the president has had to contend with militant ideologues and has been unable to implement his agenda. I know this because I’ve had to listen to years of hand-wringing about politicians' inaction. You can’t have it both ways.

SOURCE

****************************

Truth Is, There's No One Behind the Wheel

By Jonah Goldberg

There’s an old joke in the newspaper business, now immortal on the Internet:

“The Wall Street Journal is read by the people who run the country. The Washington Post is read by people who think they run the country. The New York Times is read by people who think they should run the country. USA Today is read by people who think they ought to run the country but don’t really understand the New York Times. They do, however, like their statistics shown in pie chart format. … The Boston Globe is read by people whose parents used to run the country, and they did a far superior job of it, thank you very much. …”

And so on. The list gets updated from time to time, and it usually includes, “The National Inquirer is read by people trapped in line at the grocery store.” You get the point.

But the joke is on us. You see, no one is running the country.

I don’t mean that as a knock on President Obama. No president “runs” America because the government doesn’t run America – and the president barely runs the government. He can scarcely tell his own employees what to do. Civil service laws and union rules make it darn near impossible to fire even grossly incompetent employees for anything short of pederasty or murder.

I don’t have the space to rehash the Federalist Papers, but at the federal level there are three branches of government and each one monkey-wrenches the other, all the time. Meanwhile, do you know how many local governments there are in the United States?

Time’s up, and you probably guessed too low. There are, by the Pew Charitable Trust’s count, just over ninety thousand of them (90,056 to be exact).

What the joke gets right is that lots of groups think they should be running the show. But they all resent the fact that they’re not. From Ivy League eggheads to Wall Street fat cats, everyone talks like a backseat driver to a driver who isn’t there.

In recent years, I’ve had the good fortune to get to know some famous .001-percenters. Guess what? Not only do they not run the country, but they’re often desperate to find out who does.

For instance, listening to the Democratic Party or, say, the editors of the New York Times (tomayto-tomahto, I know), you’d think the Koch brothers owned America. Of course, if they did, they wouldn’t be spending so much money on elections, would they? Also, if the Kochs were half as evil and powerful as some claim, nobody would be criticizing them.

Meanwhile, for every rich conservative out there, there’s a rich liberal cutting checks, too. In other words, the one-percenters who supposedly run everything aren’t some homogenized class of economic overlords; they are, in fact, at war with each other. And, trust me, Charles and David Koch, Sheldon Adelson and Foster Friess no more think they are running the country than liberal super-donors Michael Bloomberg, George Soros and Tom Steyer do.

The notion that there’s a class or group of people secretly running things is ancient. It was old when the Roman consul Lucius Cassius famously asked, “Cui bono?” (“To whose benefit?”)

The reason is that we seem to be hardwired to assume there are no accidents, that the world is the way it is because people – hidden people – want it that way. The more extreme expressions of this cognitive reflex take many forms, whether anti-Semitic (Who benefits? The Jews!) or Marxist (Who benefits? The ruling classes!) or comedic (“Colonel Sanders with his wee beady eyes!”).

Today, on the left, such thinking has become institutionalized. When the champions of social justice can’t find an actual culprit, the villain becomes systemic racism or sexism or white privilege. But there is always evil intentionality lurking somewhere, like a ghost in the machine. The right has its bugaboos, too. For instance, there are many who think the mainstream media is biased (it is) and that its bias is somehow centrally orchestrated like a scheme by some Bond villain (it isn’t).

I think some people are scared of the idea that nobody is in charge, in part because they want someone to blame for their problems. Others don’t like this notion because they have an outsized faith in the power of human will. If villains aren’t to blame for our ills, then some problems cease to be problems and simply become facts of life.

Me? I like knowing no one is running things because, for starters, it means I’m free.

SOURCE

******************************

Do you or yours feel better? Last week’s GDP Estimate Included a Massive Upward Revision in Health Spending

Massive spending for what benefit?

Last week’s third estimate of 3rd quarter GDP contained a significant upward revision to the real (inflation-adjusted) increase in GDP, from a 3.9 percent in the second estimate (released in November) to 5.0 percent in the third estimate.

November’s second estimate of 3rd quarter GDP included very tempered growth in health spending. The third estimate blows that out of the water. Much of the upward revision to the GDP estimate was due to health spending.

The real dollar change in seasonally adjusted GDP (at annual rates) from the 2nd quarter to the 3rd quarter was estimated at $153.7 billion in the second estimate. The third estimate revised this up to $195.2 billion, a change of $41.5 billion (27 percent).

Health spending was revised up from $8.6 billion to $20.7 billion, an increase of $12.1 billion. That is, the upward revision of health spending accounted for almost one-third of the entire GDP revision. Health spending is a component of household consumption of services. The entire revision to that category was $21.8 billion. So, pretty much the entire net increase in the estimate for household consumption of services was accounted for by health spending.

Whether this is good or bad for Americans’ welfare cannot be determined from these figures. Especially under Obamacare, health spending is so politically driven that subsidized spending may be increasingly wasteful.

What is also concerning about these revisions is that figuring out the impact that Obamacare is having on health spending has been exceedingly difficult. Let’s hope that we are not back where we were last summer, when the Bureau of Economic Analysis was struggling to capture health spending accurately in its GDP estimates.

SOURCE

***********************

For more blog postings from me, see TONGUE-TIED, EDUCATION WATCH INTERNATIONAL, GREENIE WATCH, POLITICAL CORRECTNESS WATCH, AUSTRALIAN POLITICS, and Paralipomena (Occasionally updated) and Coral reef compendium. (Updated as news items come in). GUN WATCH is now mainly put together by Dean Weingarten.

List of backup or "mirror" sites here or here -- for when blogspot is "down" or failing to update. Email me here (Hotmail address). My Home Pages are here (Academic) or here (Pictorial) or here (Personal)

****************************

Tuesday, January 06, 2015

Is this the ultimate dumbing down of education? Has educational success now become just a popularity contest?

If "niceness" gets you better grades than intelligence, it seems so.

A recent academic paper says personality is more important than IQ to educational success. And since the criterion of academic success was GPA I can believe it. GPAs these days are not a strong indicator of academic ability. They could well be influenced by "niceness". Teachers tend to give higher marks to students whom they like. And, as we know, GPAs are not a strong indicator of success in later years. IQ was in the past by far the best predictor of academic success but most of those findings go back to an era where education had not yet been "dumbed down".

Another problem is that high IQ students often find schoolwork boring so treat it cursorily, which is not a good way to get high marks, meaning that GPA marks may not adequately represent ability.

Leftists have always derided IQ because it is one of those pesky inborn differences that obstruct their dream of making everybody equal. It seems that they have now gone beyond derision and are actively making IQ irrelevant. Below is a popular summary of the paper followed by the journal abstract.

According to a new review of the link between personality and academic achievement, personality is a better way to predict success at school than intelligence as it's usually measured, by traditional standardized tests. Arthur Poropat, of Griffith University in Australia, compared measurements of what psychologists call the "big five" personality traits — openness, conscientiousness, extroversion, agreeableness, and neuroticism — to academic scores, and found that the students who were rated higher in openness and conscientiousness tended to receive better grades.